Will Trump Launch a Trade War with China?

President-elect Trump is a media whiz and a master of rhetoric and demagoguery who has captivated those under-educated predominately WASP (and Catholic) blue collars and rural rednecks who perceive themselves as losing out in the race against workers in other countries coupled with the onslaught of technology. One mantra that he has successfully drilled into their tiny and narrow minds is that “China is raping America” through unfair trade practices such as manipulating its currency, outwitting US officials at the negotiating table, or unfairly undercutting US competition by subsidizing exports, among numerous other charges.

Two and a half weeks before his election, Trump unveiled his “100-day plan to Make America Great Again”. Apart from pledging to turn Washington upside down and inside out, he set his administration’s agenda on trade, energy, climate change, security and immigration. Of particular interest is the seven priorities for “protect(ing)” American workers, the first four of which deals with trade. First, he would renegotiate the North America Free Trade Agreement (NAFTA) with Canada and Mexico; and failing that, would withdraw from it under Article 2205. Then, he promised to renounce Obama’s Trans-Pacific Partnership (TPP) framework (that excludes China); after which he would label China a currency manipulator, and finally “identify all foreign trading abuses that unfairly impact American workers” and take all measures to halt them and punish the perpetrators.

First, let’s look at NAFTA under which all three countries have reaped enormous benefits in terms of jobs, trade, and investment. Asked about the prospect of renegotiations for the two-decade old agreement by NPR, Eswar Prasad, a renowned trade and currency economist at Cornell University opined that doing that “would not be a trivial matter”. Changing it would hurt many US businesses and farmers that are dependent on well-established supply chains and distribution systems based on the agreement. Nonetheless, Trump could make life very difficult for businesses doing cross-border trade by using his administration’s enforcement mechanisms. So, while NAFTA would live on in name, it would be gravely injured if not on its deathbed in spirit, Mr Prasad underscored.

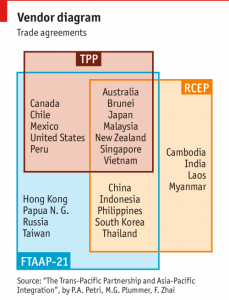

TPP, a key pillar of the Obama Administration’s ‘pivot’ to Asia, has yet to be ratified by the US Congress. President-elect Trump’s condemnation of the pact as a “disaster” plus that this time around the Republicans control both the House and the Senate, not to mention maintaining a big majority among state governors, has ensured that the agreement is dead-in-the-water. In fact, a former economic advisor to Vice-President Biden most recently Twittered the Obama government has given up on a lame-duck vote on it. Meanwhile, the China-led Regional Comprehensive Economic Partnership (RCEP) negotiations are forging full-speed ahead that encompasses more than 3 billion people inhabiting China, India, ASEAN, Japan, South Korea, Australia, and New Zealand. In a mirror image of TPP, the US is not included in the talks.

Trump made ‘China-bashing’ a hallmark of his campaign and he has pledged to call China out as a currency manipulator. In addition, his campaign manifesto called for an end to China’s “illegal export subsidies”, lax labour laws, and ineffectual environmental standards, promising to “cut a better deal with China that helps American businesses ad workers compete”. Claiming China keeps the RMB artificially low to boost its exports, Trump has threatened “appropriate countervailing duties on artificially cheap Chinese products” to the tune of as much as 45% (along with 35% on Mexican products). The American government has not designated China a currency manipulator since the Clinton Administration in 1994 and both the Bush junior and Obama Administrations refrained from doing so.

Trump has seesawed on the issue during the campaign though. In a Republican candidate debate back in March, he clarified that his statement on anti-China tariffs was merely a threat. “The 45% is a threat that if they don’t behave, if they don’t follow the rules and regulations so that we can have it equal on both sides, we will tax you”, he explained. And when asked about the high probability for igniting a trade war, Trump cavalierly retorted, “who the hell cares?”

But, will Trump follow through with his threat after all? If he does, the ramifications for both economies will be devastating indeed. In a September report, the pro-trade Washington-based Peterson Institute for International Economics stated a trade war with China would shock the US economy back into a recession and cost as many as 4 million private sector jobs nationwide, hitting lower-income and lower-skilled workers disproportionately more, the very constituents that voted in force for him. In a related report the Institute modelled that regionally, specifically California, could lose 640,000 jobs by 2019 with Los Angeles hardest hit losing 176,000 jobs.

Capital goods industries would be worst affected that would strongly ripple throughout the economy, erasing jobs in retail, restaurants, and temporary employment agencies. Chinese tit for tat retaliation would be a certainty. By simply instructing its state-owned enterprises to cease buying US company services, for instance, California could lose almost 14,000 high-end jobs, with nearly 6,000 lost in LA and Orange counties alone. If China put purchases of American aircraft on hold, the entire region would experience additional job losses. It is interesting to note that the last time the US erected protectionist barriers against foreign imports back in the 1930s, they exacerbated and prolonged the Great Depression.

Yet, some analysts believe Trump may take some action, if not a full-powered 45% tariff. In a note to clients, Wei Tao, a China specialist at Societe Generale wrote a high tariff is out of the question but a watered-down tariff of 15% (and a lesser one for Mexico) is entirely possible. A 45% tariff would be ruinous for China’s exports to the US. In a note, Kevin Lai, an analyst with Daiwa Capital Markets estimated Chinese exports bound for the US could plummet by an astounding 87% or $420 billion whereas a 15% tax would see Chinese exports fall by 31% that could cut 1.75% off China’s GDP. But, because it is a key driver of the world economy, a trade-battered China would produce tremendously negative repercussions across the globe that is already witnessing weak demand and eventually rebound squarely on the US.

So, will Trump resort to ‘cutting off the nose to spite the face’? The world will be watching with nervous anticipation over the initial months of his administration.