CWF: Build and Expand Pipelines for Alberta Oil Sands Crude

Pipeline bottlenecks are costing Canada multi-millions a day and the reluctance of Canadians to address shortfalls in efficient oil transport to foreign markets could put western Canada’s oil and gas sector at risk, declares Pipe or Perish, a new report by the Canada West Foundation. Commissioned by the government of Saskatchewan, the report also outlined the economic benefits of proposed pipelines to the west coast, eastern Canada, and the eastern seaboard of the US via the mid-west. This post focuses on the implications of burgeoning Asian markets, especially China’s, for Canadian crude exports.

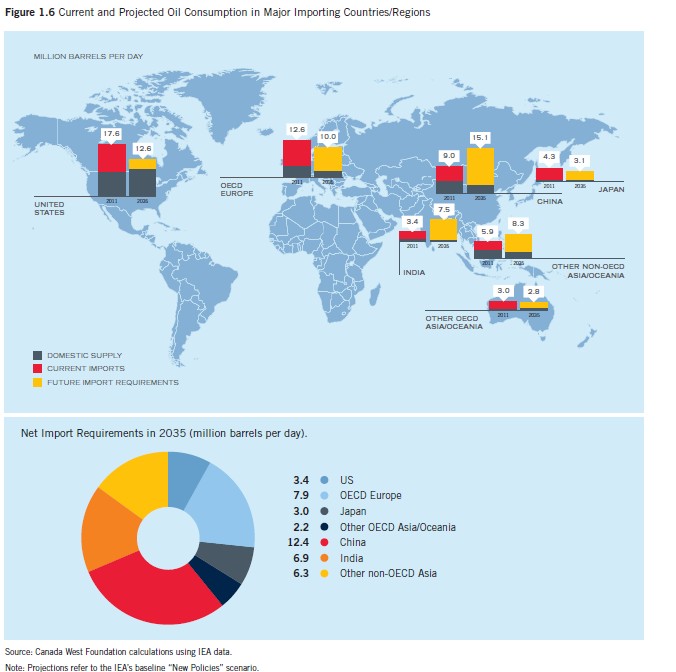

According to International Energy Agency (IEA) world oil consumption scenarios, China is expected to become the world’s largest oil consumer before 2030 and account for half of global growth in oil consumption through 2035. Even in the most stringent ‘450 scenario’ under which China meets emissions targets by 2035 and introduces an escalating system of carbon pricing, her oil demand will not peak for another 13 years (2025). China’s import demand will rise by 153% and other developing Asian markets by 132%.

Eventually, China will need to import more than three times as much oil as western Canada currently produces but Canada has “very little physical access to that market”, the report pointed out. Moreover, going by all long-term supply projections, western Canadian crude production will at least double by 2035. Currently, western Canada has seven major pipelines that transport diluted bitumen, crude oil, and refined petroleum from the region, mainly to the US mid-west.

But, future growth lies in developing Asia, not the US: First, US demand for crude oil and petroleum products is either flat or declining. Add to this booming US production in light of its shale oil and gas revolution that will dramatically reduce American dependency on foreign oil. Further, there is substantial resistance to the oil sands from US environmentalists who have lobbied the Obama Administration hard against the Keystone XL pipeline. Finally, due to pipeline bottlenecks, western Canadian producers are selling oil at steeply discounted prices.

Given the refinery building boom in China, it is more rational for Canadian producers to sell crude rather than refined products, argued the report: “The combination of high capital costs and small per-barrel return on that investment makes bitumen upgrading a risky proposition. Rather than expose ourselves to that risk, many companies are choosing simply to export diluted bitumen to US (foreign) refiners”.

Currently, Kinder Morgan’s Trans Mountain pipeline is the only direct link to the west coast but improving access to Asia via this line is limited because it is only able to deliver 300,000 barrels a day (b/d). Refined products go to BC customers and crude oil to Washington State for refining. Only a tiny fraction lands at the Burnaby Terminal for overseas shipment.

The critical but controversial Enbridge Northern Gateway line from Edmonton to Kitimat would be able to transport 530,000 b/d of diluted bitumen and synthetic crude. Expansion of Kinder Morgan Trans Mountain from Edmonton to Vancouver would add another 590,000 b/d in crude oil and refined products. Together, these two pipelines would be able to transport nearly 1 million b/d of crude to Asian markets. But, the challenge, underscored the report, is “getting these projects approved and completed in a timely manner”.

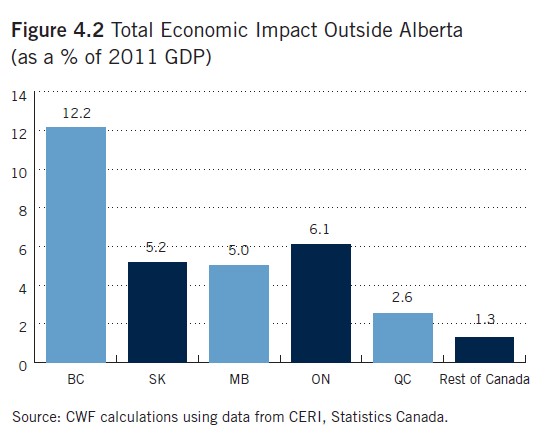

The combined economic impact of extending Trans Mountain and building Keystone XL and Northern Gateway would be immense, Michael Holden, senior economist and author of the report, told the Canadian press: “(if the three pipeline proposals don’t go forward) Canada will be foregoing $1.3 trillion in economic output and 7.4 million person-years of employment and $281 billion in tax revenue between now and 2035”. While the lion’s share of benefits will go to Alberta, an additional $84 billion in economic activity would accrue to other provinces, including $32 billion to other western provinces.  By far, the biggest beneficiary outside of Alberta will be BC which would gain the equivalent of 12.2% in 2011 provincial GDP over the projection period. Combined with other pipeline proposals going east and south, Ontario, Saskatchewan, and Manitoba would enjoy a boost of between 5% and 6.1% in 2011 GDP terms.

By far, the biggest beneficiary outside of Alberta will be BC which would gain the equivalent of 12.2% in 2011 provincial GDP over the projection period. Combined with other pipeline proposals going east and south, Ontario, Saskatchewan, and Manitoba would enjoy a boost of between 5% and 6.1% in 2011 GDP terms.

Infographic: Expensive Foreign Products in China

This is a frequent complaint from Chinese consumers. Hence, their penchant to shop overseas for famous brands. Not-so-famous-brand imported foods are also unreasonably high (tariffs etc. as explained in the infographic). To be fair, price disparities between foreign and Chinese brands can be massive. For instance, at certain Chinese coffee shops, coffee can be as cheap as 8 RMB per cup, using the same beans and espresso machines.

—————–  – business.sohu.com via East-West-Connect.com

– business.sohu.com via East-West-Connect.com