China’s Economy Rebalancing Just Fine

Services now account for 50% of China’s GDP, up from 42% 10 years ago, according to World Bank data. This continuing shift may indicate the government’s planned move toward services, innovation, and household consumption as the new economic drivers is going along to plan.

Source: World Bank, World Databank, as of 2015.

Bloomberg reports there are already more than 300 million people working for chinese services companies in retail, restaurants, hotels, and real estate. But the size of the service sectors in both developed and developing nations around the world suggests China still has significant room to grow.

The United States, for example, derives almost 80% of its GDP from services, according to Central Intelligence Agency data. Japan and Germany get more than 71% each, while the United Kingdom and France are both near 80%.

Fellow emerging market countries Brazil, Russia, and India also have greater service sector contributions than China, deriving 67%, 60% and 57% of their GDP from services respectively.

This is a lead China wants to follow, with the country’s 13th Five-Year Plan making raising the service sector’s contribution to GDP a priority. It’s anticipated by China’s leaders that growth driven by consumption and services can drive it to become a high-income nation.

– Business Insider

Forum on Great Power Competition in the 21st Century

This week, the 13th annual Valdai Discussion Club forum, the Russian equivalent of the Swiss-based World Economic Forum or the annual Boao Forum in Hainan, China, convened in the famous resort town of Sochi, better known for hosting the 2014 Winter Olympics. Not surprisingly, the forum, where Russian President Vladimir Putin gave a keynote address, wasn’t covered much by the Western press but the panel for its first session titled World Order: Quo Vadis? featured some heavyweights in the ongoing debate on Sino-US relations.

The main protagonists were Madame Fu Ying, Chairperson of the Foreign Affairs Committee of China’s National People’s Congress and a former vice Foreign Minister and Professor John Mearsheimer, the renowned political realist theorist from the University of Chicago, along with Kevin Rudd, former Prime Minister of Australia now President of Asia Society’s Policy Institute, Sergei Karaganov, a big-wig foreign policy scholar and advisor to the Russian government and an Indian academic. The discussion centered on the transition from an unipolar world under US dominance since the collapse of the Soviet Union to a multi-polar one with Russia and China jointly vying to end the US hegemonic era and attempting to carve out respective spheres of influence.

As a scholar firmly anchored in the realist tradition in international relations, Professor Mearsheimer points out that since the end of the Cold War, the Western and in particular US foreign policy establishment has been dictated by the liberal (neo-liberal) interventionist school. Liberal interventionists’ desire to mold the world in its own image in ideology, political system, and economic structure prompts them to use overwhelming military power coupled with its alliances to enforce its wishes. Political realists, on the other hand, believing in balance of power and spheres of influence, argued for restraint in such areas as the eastward expansion of NATO which forced Russia’s hand in the Crimea, or interventions in the Middle East in pursuit of toppling unsavory regimes that resulted in millions of refugees fleeing to Europe, and confrontation with a rising China in the South China Sea that has caused heightened tension in the region.

In terms of Sino-US relations, Mr Mearsheimer remains a pessimist believing the inexorable rise of China and its expanding political and economic influence throughout East and Southeast Asia pitted against the behavior of the US as the current hegemon in seeking ways to contain that, will inevitably result in conflict. Under this scenario, both powers are captured by the “Thucydides Trap” which in Greek antiquity saw a great war erupt between a rising Sparta versus an Athens feeling threatened by its expansionism. In contrast, speaking from the Chinese perspective, Madame Fu Ying refutes this theory of inescapable conflict.

For Ms Fu, China sees many ills of the US-dominated order, especially its propensity to militarily intervene in Third World countries assisted by developed world partners, and does not wish to repeat those mistakes. At the same time, China will not stand idly by when the US ostracizes its political system and security interests. Neither would other major emerging powers such as Russia or India. It’s not a simple choice of submitting to or challenging American power as Mr Mearsheimer suggests for China upholds an alternative view of the international order centered around the UN.

As a founder, supporter, beneficiary, and more recently reformer of the international system, China finds it comfortable to stay within its framework that has allowed it to prosper for almost forty years. However, shortfalls of the extant system must be addressed; namely, the uneven benefits of globalization, skewed distribution of wealth, unbalanced development, and lack of sufficient oversight over capital flows, not even mentioning the many military incursions spearheaded by the US. China wants a new model of great power relations and global partnership through such initiatives as One Belt One Road, the establishment of the Asian Infrastructure Investment Bank, the new BRICS bank, and various regional China-backed development funds and projects. Rather than feeling insecure, the US should join hands with China for its own gain, Ms Fu urged.

Fundamentally, as China ascends on the world stage, it wants some quid pro quos from the US and its Western allies. First, mutual respect especially in the political arena under which no country tries to impose values and systems on others. Second, the US should not achieve its own absolute security at the expense of the security of others. Instead, there should be more common security where geopolitical rivalries and bloc formation are minimized. Third, in the economic realm, China adheres to “inclusive development”, a theme highlighted at the recent Hangzhou G20 Summit and exemplified by China’s infrastructure and other building throughout Asia, Africa and latin America. Finally, China must better explain itself to the global audience while learning from other countries and being open to new ideas as it develops its own thinking.

In spite of Fu Ying’s appeal, Mr Karaganov remained unconvinced about a new more cooperative order under which America becomes willing to share power with China and Russia. In fact, Russia and China are already working hard to alter and deconstruct the US-led order in different ways – Russia using the big stick and other “hard” means and China through offers of carrots and other “soft” means. Moreover, Messiers Karaganov and Mearsheimer agree that continuing efforts to isolate and confront Russia over Ukraine and Syria, for example, only serve to further drive Russia into the willing embrace of the Chinese. They also perceive the role of the European Union as being relegated to passivity on the world stage largely reliant on the actions of the US, Russia, and China.

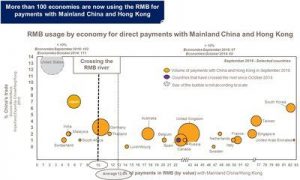

101 Countries Using RMB for Payments with Mainland China and Hong Kong

The latest RMB Tracker shows that during the last two years (October 2014 – September 2016), seven new countries are now using the RMB for more than 10% of their direct payments by value with Mainland China and Hong Kong, bringing the total to 57 countries worldwide. The 10% milestone, also known as ‘crossing the RMB river’, is a threshold set by SWIFT to measure the adoption of RMB payments by value with Mainland China and Hong Kong compared to other currencies. Among the 101 countries using the RMB for payments, the weight of these payments by value reached 12.9%, giving the currency a nearly 2% increase since October 2014 (11.2%).

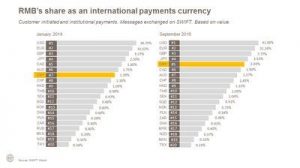

Overall, the RMB kept its position as the fifth most active currency for global payments by value, with an increased share of 2.03%, compared to 1.86% last month. In September 2016, the value of RMB global payments value increased by 10.02% compared to August 2016, which is higher than the average growth of 0.93% for all currencies.

– PRNewswire