China On Top Again in Clean Energy Investment: Bloomberg

Many foreigners, especially Americans, mock China for its atrocious air pollution but few realize the extent to which the government and Chinese companies are investing in clean energy solutions. Here is a synopsis:

China kept the crown for global clean energy investment in 2014, particularly solar and wind. The Bloomberg New Energy Finance report said the country’s investment in clean energy last year hit a record US$89.5 billion, a 32% jump over 2013 and accounting for about 28.9% of the world’s total. Investment worldwide totaled US$310 billion, up 16%, driven by surges in investment in solar energy in China and the United States, and offshore wind energy in Europe.

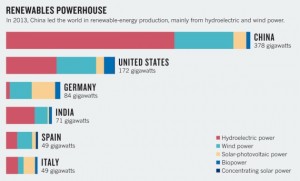

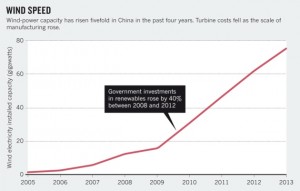

In 2013, China generated more than 5.4 TWh (1000 GWh) of electricity, about 1.1 TWh more than the US (or as much as the US and India combined). China’s investment in hydroelectric, wind, solar and nuclear power capacity increased by 40% between 2008 and 2012, from 138 billion RMB (US$22 billion) to around 200 billion RMB. Hydroelectricity accounts for the vast majority of power generated through renewables that now reaches 9.6% of all energy used in China, up from 5.6% in 2000 and on track to reach 20% by 2020.

In 2013, China added 16.1 GW to total 91.4 GW of installed wind power capacity, cumulatively growing by 21% – well on track to reach and surpass the 100 GW wind power target by 2015. Citigroup estimated China’s super windy provinces – Hebei, Gansu, Xinjiang, Jiangsu, Jilin, and Inner Mongolia – could easily install 131 GW of capacity by the end of the decade while a government plan looks to installing 200 GW.

Meanwhile, solar power stood at 19.4 GW with almost 13 GW added in 2013 itself. With such an aggressive installation pace, China stands an excellent chance of installing 35 GW solar power capacity by the end of the year. China is also upgrading its power grid to accommodate power fluctuations and distributed generation for intermittent sources.

———-

– China Daily/Asia News Network: http://news.asiaone.com/news/business/china-retains-global-top-spot-clean-energy-investment

China to Set Up VC Fund to Spur Innovation

On this blog, I’ve talked about China’s dramatic rise on various annual assessments of worldwide patent registrations; on China’s ambition of becoming an innovation superpower by 2020; on the UN’s positivity viz. China’s innovation trajectory; and so on. Now, the Chinese government is putting state funds into private innovation through the setting up of this VC fund. This is a major initiative focusing on start-ups that will spur private Chinese innovation into the next decade.

———-

China will set up a government venture capital fund worth 40 billion yuan (US$6.45 billion) to support start-ups in emerging industries, in its latest move to support the private sector and foster innovation.

“It will also help breed and foster sunrise industries for the future and promote (China’s) economy to evolve towards the medium and high ends,” it said in the statement published in the government’s website, www.gov.cn,, referring to sectors which the government is promoting such as technology and green energy.

The government issued the statement after a meeting on Wednesday. It did not give a timetable, but past experience has shown that such a fund could be established within a few weeks after an announcement.

China’s venture capital market remains small, the legacy of the country’s decades of the planned economy in which private sector’s development is largely subject to a great variety of restrictions.

In the first half of 2014, 83 new funds were set up in China’s venture capital market, with fresh capital eligible for investment in the mainland surging 157 percent from a year earlier, but remaining at a moderate $6.76 billion, according to a research by Zero21PO Capital, a service provider and investment institution in China’s private equity industry.

During the period, 517 investment cases occurred in the market, with details of 440 made public on a combined investment capital of $5.3 billion, the research showed.

Still, the government is increasingly supporting the expansion of the industry since two years ago when mapped out a strategy to let market forces to eventually play a “decisive” role in China’s economy.

Last month, for instance, regulators issued new rules to allow insurance companies to invest their huge pool of premiums in venture capital funds for the first time.

The cabinet said in Wednesday’s statement that the planned fund would be funded by the government’s existing capital designated for expansion of emerging industries and by state corporates, while also inviting private partners to participate in.

The fund will render public tenders to invite high processional asset managements to operate, with returns giving priority to private investors, it said.

– Reuters

The Taxman Cometh

Knew it would happen someday and it’s beginning this year: China’s taxman is going after Chinese nationals worldwide for income tax. China is now the second nation after the US to tax based on citizenship not residency. China is bearing down on nationals earning large incomes overseas as it prepares for increasing social security budgets in the coming decades.

———-

When the political leaders of the People’s Republic of China decided to modernize the country’s federal tax system in the early 1990s, they carefully examined the rules in place in other counties. They eventually concluded their empire-building ambitions would best be served by adopting the key design features of the IRC — including citizenship-based taxation of personal income.

Yet for the past 20 years, China’s State Administration of Taxation (SAT) has declined to enforce this rule. As a result, Chinese expats have grown accustomed to not paying Chinese income taxes on their foreign salaries. The government’s failure to apply the law has been attributed to limited organizational resources inside the SAT and the non-availability of pertinent income data from private employers. It’s also been suggested that by going soft on expats, the government indirectly promotes the expansion and global influence of Chinese firms.

Whatever the case, Beijing is no longer looking the other way. Beginning in 2015, the government expects all Chinese citizens residing abroad to include their foreign salary and wages in taxable income. Why the change? The best answer appears to be that the Chinese government needs the money to meet its spending needs.

Viewed in isolation, this development could easily be overlooked. But when considered alongside other recent steps, it seems clear that China’s central government is newly emboldened when it comes to revenue collection. As this trend continues, it wouldn’t be surprising to see China’s tax framework become more like America’s with each passing year.

– Forbes