Investment Cuts Both Ways

China has been on a worldwide buying binge in recent years with its state-owned enterprises (SOEs) splurging US$111.6 billion (C$146 billion) in the first seven months of this year alone, reported Reuters. That figure already surpasses the US$111.5 billion mark set by China’s outbound FDI for the entire year last year and approaches the total amount of inbound FDI of US$126.27 billion. But, as Chinese state firms celebrate their successes, they face increasing push-back on national security and market access grounds, not to mention totally unrelated red herrings such as China’s South China Sea (SCS) claims and ‘human rights’ record.

Two cases in particular stand out – in July, the post-Brexit-Cameron government of Theresa May launched a surprise review of the US$24 billion Hinkley Point nuclear project at Somerset which is being co-financed by SOE China General Nuclear Power Corp. (CGNPC), bringing a sharp halt to the much-touted “golden age” of China-UK relations spearheaded by the former Cameron-Osborne team.

Then, in August, Australia blocked the A$10 billion (C$9.887 billion) sale of a 50.4% stake in Ausgrid to China’s State Grid Corp. and Li Ka-Shing’s Cheung Kong Infrastructure Holdings. Analysts believe the veto, which follows the ban on the massive 101,000 km2 Kidman family farm sale to Chinese interests last year, owes much to seats won by the NXT and the One Nation party, two right-wing protectionist blocs in the Australian Senate following recent national elections.

The decisions did not go down well in Beijing. In the wake of May’s decision, Chinese Ambassador to the UK Liu Xiaoming warned, “the China-UK relationship is at a crucial historical juncture. Mutual trust should be treasured even more.” The situation has not been helped by the fact that a trusted advisor of the new Prime Minister who has her close ear is an ardent Sinophobe who wrote a scathing diatribe against China last October accusing the previous government of selling out Britain’s national security. On top of that, the US Justice Department charged an American national working for CGNPC of illegally developing and producing special nuclear material in China.

In a bid to appease the Chinese, Ms May sent a high-ranking Foreign Office official to reassure Chinese Foreign Minister Wang Yi that Britain attached utmost importance to Sino-British cooperation. Ms May also made a personal appeal to Chinese President Xi Jinping and Premier Li Keqiang in the form a letter. Currently on her first trip to Beijing as Prime Minister for the G20 Summit, she’s seeking to comfort the Chinese that despite the Hinkley delay, Britain wants to solidify ties that are wide-ranging and multi-faceted.

In blocking the Ausgrid deal, the Australian authorities had expressed concerns that the main electricity network serving 1.6 million homes and businesses in Sydney and beyond in New South Wales, the country’s largest state with 7.5 million inhabitants, could be compromised in times of crisis. Although Scott Morrison, Australia’s Treasurer, declined to comment on specific national security risks the sale posed, sources cited dangers of Chinese cyberattacks and electronic espionage. Not surprisingly, xenophobic Senators in the governing coalition pointed to SOEs, the SCS dispute, and the nature of the Chinese government as key red flags.

But, red herrings aside, there is nonetheless a palpable change in foreign attitudes toward Chinese investment in general and Chinese SOE money in particular. “Protectionism is resurfacing. In many parts of the world, we have seen calls for deglobalization”, commented Chinese deputy Foreign Minister Li Baodong. But, it’s not just trade protectionism that’s rearing its ugly head but Western business groups and government officials are ever louder raising long-standing gripes about access of their companies to the Chinese market.

They point to restrictions on foreign companies in Chinese industries such as financial services, healthcare, and logistics. Just prior to the G20 Summit, a European Union Chamber of Commerce (EUCC) annual paper stated bluntly, “this unbalanced situation is not political sustainable and for its own benefit, China should begin reciprocating by opening and allowing European business to contribute more to its economy…If it is ultimately unwilling to offer reciprocal access to its own market, China cannot assume that it will indefinitely continue to enjoy open and unhindered access to the EU’s.”

Joerg Wuttke, President of the EUCC in China warned of a protectionist backlash saying nowadays European officials are more daring to speak their minds on the reciprocity issue. “It has reached the point where people are not afraid to speak up anymore. They feel like they have to be tougher in front of their constituencies”, Mr Wuttke told the media. A EU official involved in China trade added, “The Chinese would shut you down at once if you said you wanted to buy one of their grids. You wouldn’t get to the end of the sentence”.

In terms of policy, the EU recently introduced a groundbreaking expanded review process focusing on all assets managed by the State-owned Assets Supervision and Administration Commission (SASAC) under China’s State Council. This means an extra layer of oversight that could delay or even scuttle future Chinese SOE M & As of European companies, forcing them to jump through more hoops in a lengthy approval process.

The good news is that, on the other side of the Atlantic, the latest annual China-US Strategic and Economic Dialogue ended with a commitment to expedite the conclusion of a Bilateral Investment Treaty (BIT), a key issue for which is foreign access to protected sectors and the whittling down of China’s “negative list” of off-limits industries.

The US-China Business Council (USCBC) declared: “a high-quality US-China BIT would give American companies better access to China’s market and equal rights as Chinese firms”. A BIT would also help alleviate Chinese concerns over the activities of the US government agencies such as the Committee on Foreign Investment in the United States which has blocked a number of Chinese investments in the US before.

Robert Held, a Geneva-based financial consultant writing in the Asia Times newspaper suggests unless China starts allowing more reciprocity in market access, mistrust over China’s SOEs will only rise. Protectionism against Chinese SOEs “will become more stringent (in the US) and even more dramatically, in the EU, could become the norm. The writing is on the wall: reciprocity can no longer be postponed by Beijing without hurting its own interests”, he argued.

RMB’s Share of Global Trading Doubles in Three Years: BIS

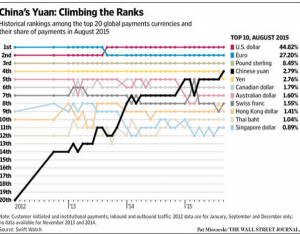

Currency analysts and RMB trackers are predicting the RMB will take fourth spot by 2020.

______________________

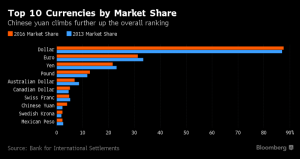

China’s yuan has doubled its share of global currency trading in the three years through April 2016, according to the latest triennial survey conducted by the Bank for International Settlements.

The yuan’s average daily turnover rose to $202 billion in April from $120 billion in the same month of 2013, boosting its ratio of global foreign-exchange trading to 4 percent from the previous 2 percent, the survey results show. That puts the currency in eighth place overall. Dollar-yuan became the sixth-most traded currency pair, advancing from ninth place in 2013, BIS said, while the yuan overtook the Mexican peso as the most actively traded emerging-market currency.

The survey polled central banks and other authorities in 52 jurisdictions, with data from almost 1,300 banks and other dealers, BIS said. The dollar increased its lead as the most-traded currency with 88 percent of deals, up a percentage point from three years ago. The euro remained No. 2, though its share fell to 31 percent. Yuan transactions in both the onshore and overseas markets were –

The Bank for International Settlements report comes a month before the yuan is scheduled to join the dollar, euro, British pound and Japanese yen in the International Monetary Fund’s basket of global reserves.

– Bloomberg on finance.yahoo.com

Seeking a “New Opportunity” or Back to “Canadian Mode”

Justin Trudeau is making a state visit to China followed by a grand appearance at the G20 Summit in Hangzhou. In the lead-up to the week-long visit, there has been much ado about Canada’s relations with the Asian superpower – deepening ties with and latching onto China’s economic coattails pitted against Canadian uninformed and in many instances misplaced anxiety over China’s “human rights” record. However, the Trudeau government, like its predecessor, may not be able avoid succumbing to divided Canadian public opinion and revert to a go-slow pace in Canada’s relations with China.

Take murmurings about Canada-China free trade agreement (FTA) talks. Despite some gung-ho hot air late last year after the election about looking at it closely, the Trudeau government has since decided to back off, intimating that it might not happen for years to come!! While Trudeau et al. may want to avoid the roller coaster ride of the Harper government, it is sending mixed messages to the Chinese who believe there is a “new opportunity” to strengthen ties and “reset” the relationship.

Meanwhile, as Canada twiddles its thumbs over FTA talks, the Kiwis and the Aussies are already miles ahead. Signed and brought into force in 2008, the China-New Zealand Free Trade Agreement is the first FTA between China and a developed country that has brought New Zealand immense profit. To be phased in gradually over 12 years with full implementation in 2019, the FTA has already served to increase especially agricultural exports from NZD2.2 billion (US$1.8 billion) in the first year to NZD8.6 billion, a nearly four-fold increase, four years later. The primary beneficiaries of the FTA are New Zealand’s dairy industry (NZD2.8 billion), wood products (NZD1.2 billion), and meat industries (NZD412 million). In the process, China overtook Australia as New Zealand’s largest export market.

The FTA was deemed so crucial to the New Zealand economy that its Prime Minister sought an upgrade that is expected to be completed by this year end. Not to be outdone, but nonetheless 7 years behind New Zealand, the Aussies signed their own FTA with China in June last year which came into force at year end. Upon full implementation of the agreement, 95% of Australian exports to China will become tariff free including many agricultural products notably beef and dairy. In addition, Australia’s services sector will be more open to private Chinese investment with projects under AD1.078 billion not requiring Foreign Investment Review Board approval.

So, there lies the dilemma for Canada – getting cold feet over fleeting public opinion and returning to slow motion on the importance of a FTA with China and sit on the sidelines as the Kiwis and Aussies reap the benefits of free trade at the expense of Canada. After all, they are direct competitors for many of the products Canada wishes to sell to China such as lumber, seafood, BC fruit and so on.

Yet, all is not lost. If a free trade deal is not in the cards, there is still ample that Canada can do short of one; that is, if Trudeau’s government truly listens to the valuable advice offered by Dominic Barton, managing director of McKinsey & Co. and the chair of the government’s economic growth advisory board. Mr Barton urges the government to move quickly on various fronts including financial and health-care services, the agri-food trade, coaxing more Chinese students to study in Canada, and finding ways for Canadian small and medium-sized companies (SMEs) to tap into China’s vast consumer markets through e-commerce companies like Alibaba and JD.com. Australia, for example, earns $20 billion a year from educating foreigners in its schools, a big segment of who are Chinese students.

Mr Barton’s company projects within a short span of 6 years (by 2022), China’s middle class (not simply the current 730 million urbanites that include working classes and migrants) will balloon to over 550 million. Among them, owing to higher-paying high-tech and services jobs, 54% will have become “upper middle” class that earn between US$16,0000 to $34,000 a year. Meanwhile, a study by consulting competitor Boston Consulting Group expects Chinese consumption to grow by 9% a year through 2020. Overall, the consumer economy is forecast to grow by 55% to US$6.5 trillion, increasing $2.3 billion or the current consumption sum of Germany or the UK. And that projection is based on the very conservative assumption that China’s economy grows by 5.5% a year, much lower than the current 6.5% to 6.7%.

Mr Barton also called on the government to reverse the former Harper government’s shut-down of Chinese investment by making capital investments more politically palatable to the Canadian public than wholesale takeovers of Canadian companies by China’s state-owned enterprises (SOEs). He also sees many aspects of the China trade-investment equation as interconnected – growing food demand from China’s burgeoning middle class over the next few years could lead to the expansion of Canada’s rail network for which China could readily invest in/build related equipment such as rail cars, locomotives, and systems. That, in turn, could tweak Chinese interest to take part in building high-speed rail (HSR) corridors in eastern Canada and elsewhere.

Finally, advisor Barton also wants to promote Canadian research and development through collaboration with Chinese venture capital and other investment as well as Chinese tech firms to establish tech clusters in clean energy for example. As for Canadian concerns about “human rights”, Mr Barton argued compellingly Canada would be better served and wield more influence through the boosting of economic and investment ties. “I think it’s very difficult to admonish people with no relationship because it’s kind of like, ‘Why should I listen to you?’, he reflected. In the void of deepening economic and cultural engagement, Canadian self-righteous utterances only sound hollow and hypocritical and do little to help change mindsets.

From the activities of Canadian ministers over the recent past, there may yet be some hope for more enlightened policy. Finance Minister Bill Morneau indicated Canada may consider relaxing its foreign investment rules, including a more accommodating approach to China’s SOE investment. Asked about reviewing restrictions on SOE acquisitions of Canadian oil assets, Morneau said his government expects to discuss with the Chinese how to spur more investment in Canada.

In a related development, Minister of Immigration John McCallum discussed with Chinese Foreign Affairs and Public Security officials in early August on opening five more visa offices in Chinese second-tier cities Chengdu, Nanjing, Wuhan, Jinan, and Shenyang, to bring the number to 15. This is to smooth the path for more Chinese to study in Canada; place more foreign talent in high-tech jobs; bring in more Chinese investment; as well as more tourists who spend more than other cohorts while in Canada. The government is even studying ways to revamp the investor immigrant program which was cancelled by the Conservatives after it amassed a backlog of about 65,000 applicants, mostly from China, followed by a failed replacement program.