CBoC: “Walk the Silk Road”

Walking the Silk Road, the title of the Conference Board of Canada’s (CBoC) latest report is indeed evocative. While the US remains Canada’s largest trading partner and will continue to be, emerging (or I should say re-emerging) markets, especially China, are taking an increasing share of both Canadian exports and imports. Canadian businesses must therefore march vigorously down the road to China and other Asian countries in the decades to come, urges the CBoC.

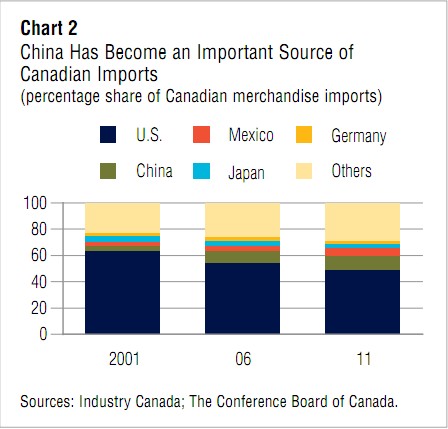

Within a decade, Canadian merchandize heading south of the border has dropped a full 13% from the peak of 87% in 2000-2001 just as China and the UK have seen big increases. Likewise, in the same period, Canadian imports from the US slid from 64% in 2001 to below 50% for the first time as China’s exports to Canada more than tripled to become the second-largest source of imports, accounting for 11% of Canada’s total. And these trends are likely to continue.

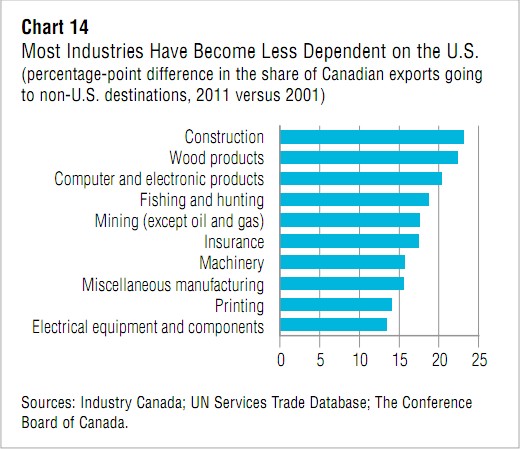

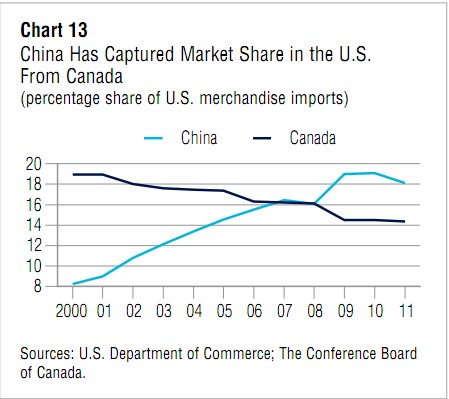

With the exception of communications, mining and miscellaneous manufacturing, Canada’s share of US imports has declined considerably across a range of industries including construction, wood and paper products, forestry and logging, furniture, printing, plastics and rubber, fabricated metal, and others. China, in particular, has steadily taken away that share to surpass Canada as the largest source of the US’s merchandize imports by 2007. Yet, this troubling trend has turned out to be blessing in disguise in driving Canadian businesses to probe new markets around the world.

Canada’s key exports to China include mineral, lumber and pulp, and canola but increasingly new product areas – chemicals, machinery, and aerospace. The same can be said of computers and electronics and services such as insurance in which well known Canadian brands Manulife and Sun Life are expanding aggressively in China and other parts of Asia. So much so that although Canada maintains a large trade deficit with China, that deficit has not deteriorated much since 2008 despite the rising tide of imports from China.

Canada’s key exports to China include mineral, lumber and pulp, and canola but increasingly new product areas – chemicals, machinery, and aerospace. The same can be said of computers and electronics and services such as insurance in which well known Canadian brands Manulife and Sun Life are expanding aggressively in China and other parts of Asia. So much so that although Canada maintains a large trade deficit with China, that deficit has not deteriorated much since 2008 despite the rising tide of imports from China.

CBoC draws some conclusions that are no-brainers: While the US continues to be Canada’s largest trading partner, Canadian companies are increasingly focusing on high growth markets in BRIC countries China, Brazil, and India. Therefore, trade negotiations with these countries will become much broader and of higher priority in the years ahead. Canada is also shifting away from traditional strengths in manufacturing to professional services and natural resources, both sectors in which China plays a major role.

At the same time, “trade between Canada, the US, and China is evolving toward a new and dynamic equilibrium based on trade specialization. Therefore policy should be focused on adaptation and promotion strategies rather than on protection”, underscored the authors.

Dovetailing with the CBoC’s conclusions is Emerging Stronger 2013, a generally upbeat survey by the Ontario Chamber of Commerce (OCC). It found that although 51% of Ontario businesses identified the Great Lakes states as the most critical markets over the next 5-10 years, interestingly, nearly as many, 45%, chose China. They recognize the importance of diversifying exports to China but currently only a fraction of Ontario’s exports go here. Close to 80% of Ontario’s exports are bound for the US while only 1.4% go to China and a paltry 0.3% to India. By contrast, Michigan exports 5.3% of its products and services to China.

Of the nearly 2400 businesses and organizations polled by OCC last December, those in eastern Ontario were most worried about the direction of the province’s economy. Jobs and Prosperity Council (JPC) figures show that Ontario businesses are ill-prepared in trade with only 7% of SMEs involved at all. More depressingly, the average value of Ontario SME exports ranks below that of 47 out of 50 US states!

To help turn things around, OCC wants to leverage Ontario’s large diaspora of Chinese and India immigrants to ferret out trade opportunities. In addition, the JPC wants to hold Global Export Forums, the first of which will highlight China and India and other countries of Asia Pacific. But, to my mind, despite such good intentions at the provincial level which are already late in the game, the federal government should be actively pursuing a free trade pact with China on the heels of the one-year old bilateral Foreign Investment Promotion and Protection Agreement (FIPPA).