China’s Aviation Market WIll be World’s Largest by 2024

China is set to overtake the U.S. to become the world’s largest aviation market by passengers by 2024 as more people take to the skies domestically and internationally, according to the International Air Transport Association.

The number of people flying to, from and within China will almost double to 927 million annually by 2025, from 487 million last year, according to forecasts from IATA made in an e-mailed statement, and reach 1.3 billion by 2035. In comparison, passengers in the U.S. will increase to 904 million by 2025, from 657 million last year, according to the predictions.

– Bloomberg

Formation of the Eurasia Market Through “One Belt, One Road”

This is a good introduction to the building of a modern day Eurasian land bridge that will ultimately form a massive market consisting of 70% of the world’s GDP. The impetus for this “New Silk Road” is Chinese President Xi Jinping’s “One Belt, One Road” initiative that he introduced three years ago. Without much fanfare, China has been helping to build transportation and other infrastructure all along age old Silk Road land and sea routes as well as providing much needed funding through new China founded multilateral banks such as the Asian Infrastructure Investment Bank, the New BRICS bank, along with various regional project funding initiatives.

http://www.forbes.com/sites/wadeshepard/2016/10/21/eurasia-the-worlds-largest-market-emerges/#47b87781783d

Chinese More Confident of China’s Role in the World

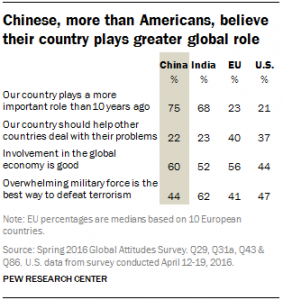

The Pew Research Center (PRC), the polling and research arm of the Pew Charitable Trusts, conducts annual surveys of global attitudes and trends that provide useful glimpses into and analyses of world opinion on various social and political issues. Its most recent poll of 3,154 Chinese respondents across the country last spring (results and analyses came out in early October) on the Sino-US dichotomy sheds light on the growing confidence of Chinese nationals about their country’s economic prospects and role in the world.

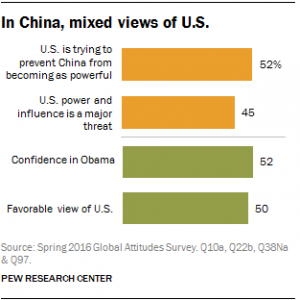

The most striking finding of the poll was that a full 3/4 (75%) of the respondents recognized China’s growing prominence in world affairs as opposed to 10 years ago with only 10% dissenting. Significantly, just under half of the interviewees (45%) said “the US is a major threat” facing the country and the world, more so than other potential threats such as the Islamic State, global economic turbulence, climate change, cyber-attacks, and others. In addition, 52% believed the US is trying to prevent China’s rise as an equal great power with only 20% thinking the US is magnanimous enough to accept China’s ascent.

In part, this confident view of China’s role stems from perceptions of how China is doing in the global economy. Compared to their European and American counterparts, most Chinese (60%) believe the country has benefitted immensely from its involvement in the global economy in terms of opening new markets and exploiting opportunities for growth with only 23% saying the contrary. What’s more, 76% believed economic conditions will a little or a lot better over the next 12 months and even more (82%) say the economic prospects of the next generation will be better than the current one.

In fact, PRC surveys indicate consistent and overwhelming satisfaction with the direction of their country for over the past decade, the only exception being in 2002 when just 48% said they were content. This is hardly surprising since 41% of China’s economy was trade driven in 2015, up 11 percentage points from 1990 but down 24 point from the high point in 2006. The IMF projects 6.6% GDP for China this year and a little lower next year. By comparison, just 42% of respondents in 10 EU countries and 44% in the US say their economies are doing well.

At the same time, however, Chinese citizens remain somewhat reticent about getting more involved overseas while being wary of increased outside influences. Despite confidence in their own economy, 77% suggest their way of life needed to be protected from foreign influences, surprisingly up 13 percentage points since 2002. Moreover, 59% were worried that territorial disputes with neighbouring countries could lead to armed conflict. As well, a majority (56%) wants the government to focus on China’s own problems as opposed to getting more involved abroad either politically or economically.

Interviewed by the Las Angeles Times newspaper, Bruce Stokes, director of Global Economic Attitudes program at the PRC and one of the authors of the report, concluded, “(The Chinese) think they play a bigger role globally than they did 10 years ago, and they’re pretty happy about that. And that does reflect an underlying reality, in the sense that it’s indisputable that China is more important. They could be full of themselves – but by the same token, they’re very worried about foreign influences. There is this combination of self-confidence, and at the same time, real wariness. I can’t explain that, but it seems it’s something we need to pay attention to – because there is an unease there…”

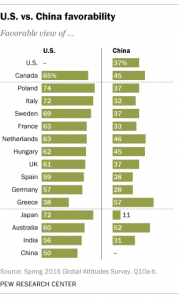

In this connection, a PRC survey conducted a year earlier on how the world views the US versus China offered a couple interesting takeaways: First, a slight majority (51%) of respondents across the world still regarded the US as the leading economic power, almost double those who perceived the reverse (26%). Yet, in the same breath, most people believe China either will eventually replace or already has replaced the US as the world’s leading superpower. Second, in terms of the US’s geopolitical rivalry with China, US’s “pivot” to Asia, both economically and militarily, received general public support on both sides of the Pacific.

The Trans Pacific Partnership trade and investment treaty that excludes China, pushed hard by the Obama Administration but openly opposed by both presidential contenders, is supported by majorities or pluralities in five of eight TPP countries who say it is more important to have strong economic relations with the US than with China. On the military front, half or more of the publics in six of ten countries think America’s rebalance of 60% of its military forces to the Asia-Pacific is a good thing for peace and stability in the region.

It would be interesting to see a new survey done in light of the foreign policy reversal of Philippine President Rodrigo Duterte and the start of various multilateral economic and banking initiatives pursued under Xi Jinping’s presidency; namely, the Asian Infrastructure Investment Bank, the BRICS bank, One Belt One Road, various free trade area talks proposals, and numerous infrastructure projects being undertaken by China around the world.

Duterte: Unlike the West, China Never Criticizes, She Just Helps Quietly

Philippine President Rodrigo Duterte is currently on a state visit to China. In an interview with China Central Television aired before his departure, Duterte praised China for its help in his administration’s war on drugs.

http://english.cctv.com/2016/10/19/VIDEiI3AM2CcFNJhbWj9VN7z161019.shtml

“Some other countries know we are short of money, (but) instead of helping us, all they had to do was just to criticize. China never criticizes. They help us quietly. and I said that’s why it’s part of the sincerity of the people,” Duterte said.

Duterte led at least 200 members of the Philippine business elite to pave the way for what he calls a new commercial alliance and played up China’s role and that of the Chinese diaspora in fostering closer ties.

“So we might be asking for your help, asking the Chinese people to help Chinese people here. They are Filipinos but they are also Chinese…My grandfather is Chinese … It’s only China (that) can help us,” Duterte said.

The Philippino President is hopeful his visit would open up avenues for aid from China. “If we can have the things you have given to other countries by the way of assistance, we’d also like to be a part of it and to be a part of the greater plans of China about the whole of Asia, particularly Southeast Asia,” Duterte said.

– JST, GMA News with Reuters

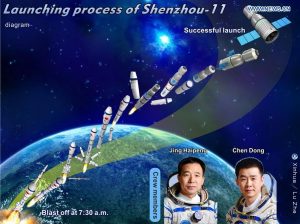

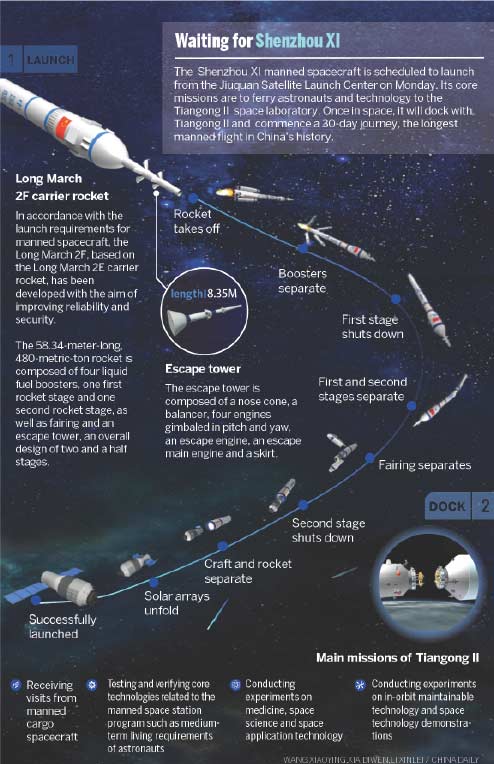

China Launches Shenzhou 11, To Dock with Tiangong II Spacelab

China launched the Shenzhou XI manned spacecraft early on Monday morning to transport two astronauts to the Tiangong II space laboratory atop a Long March 2F rocket from the Jiuquan Satellite Launch Center in Northwest China. It is carrying two male astronauts – 49-year-old Jing Haipeng and 37-year-old Chen Dong.

After the launch, the spacecraft will travel two days before docking with the Tiangong II, which was lifted from the Jiuquan center in mid-September. Then the astronauts will enter the space lab and stay there for 30 days, which will be the longest space stay by Chinese astronauts.

The core tasks of the Shenzhou XI mission are to test rendezvous and docking technologies for the country’s planned space station, to verify the life-support capability of the spacecraft-space lab combination as well as conduct scientific research and test engineering experiments.

Prior to the Shenzhou XI, China had sent five spacecraft and 10 astronauts to space since 2003, when it lifted the Shenzhou V to carry the nation’s first astronaut Yang Liwei, who is now a senior space official, into space.

China’s manned space program, a source of national pride, aims to place a permanent manned space station, which will consist of three parts — a core module attached to two labs, each weighing about 20 metric tons —into service around 2022, according to the manned space agency

– China Daily, graphics by Xinhua and China Daily

CEC Trip to Canada

A China Entrepreneur Club (CEC) delegation will embark on an eight-day journey to Canada from October 16 to 23. This is the 9th destination country for CEC’s annual visits, following successful trips to the United States, UK, France, Belgium, Australia, Singapore, Germany, and Italy.

The journey will cover the cities of Montreal, Ottawa, Toronto, and Vancouver. Canadian Prime Minister Justin Trudeau will again meet with the CEC delegation, hosting them at the Willson House residence on Meech Lake. Just six weeks ago, Prime Minister Justin Trudeau met with CEC members at the China Entrepreneur Club Leaders Forum in Beijing during his first official visit to China. It created an opportunity for a candid discussion focused on the questions of China’s private sector business leaders concerning Canada-China business relations and partnership growth.

The delegation will mainly look into the policy landscape of Canada, the opportunities during economic transformation, competitiveness in talent and technology, and foster communication with important industries including technology and innovative industries, consumer goods, and finance.

CEC’s visit will include meetings organized by Power Corporation, Bombardier, Cirque du Soleil, and The Royal Bank of Canada. Roundtable dialogues will be held with the QG100 Network, the Toronto Financial Services Alliance (TFSA), the Canada China Business Council (CCBC), the Business Council of Canada (BCC) and the Asia Pacific Foundation of Canada.

– PRNewswire

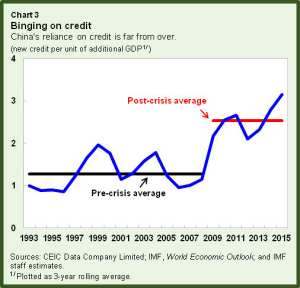

China’s Slow but Assured Economic Rebalancing

The rebalancing of China’s economy is a prolonged and sometimes tortuous process that is best described as “two steps forward, one step back”. In recent years, China’s cheap credit fueled ‘zombie’ state-owned enterprises (SOEs) have been amassing debt on a gargantuan scale pressing the International Monetary Fund (IMF) to issue a warning that the situation is “unsustainable” By some estimates, China’s corporate debt stands at US$18 trillion, equivalent to about 169% of GDP which, although average for a developing economy, is still extremely high by any measure.

Markus Rodlauer, deputy director of the IMF’s Asia-and Pacific Department, told the Telegraph newspaper in early October that “the level of financial and corporate debt and the complexity of the financial system and rapid growth in shadow banking is on an unsustainable path…The longer it lasts…the more serious the disturbance and the disruption might be…While still manageable in its size given the size of the public assets under public control, the trend is dangerous…”

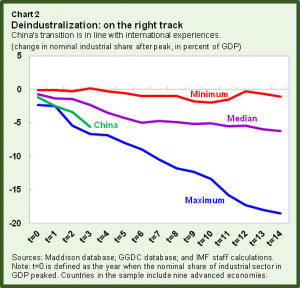

Just as the IMF warning made headlines and despite a 10% dip in China’s exports last month reflecting the fragility of global demand, it was reported that China’s overall share of global exports in 2015 actually climbed to 14.6% from 12.9% a year earlier. This is the highest proportion of world exports ever reported in IMF data going back to 1980. This rise in global export share behooves China naysayers to admit that the manufacturing slice of China’s economy is really declining with the void being filled increasingly by services and consumption as the new drivers of growth.

Longmei Zhang, an economist in the same department at the IMF, writing recently in IMFdirect, used the analogy of a high-powered and fast-sailing ship that nonetheless is listing and drawing some water to describe the current state of structural reform in China. The country has been trying to make the voyage more smoother and balanced and growth more sustainable in four interrelated dimensions’ – external, internal, environmental and distributional. Since the 2008 global financial crisis, she said China has made “mixed-strong’ progress in terms of external balancing, i.e., switching from external to domestic demand and services, but has a somewhat uneven track record in the other dimensions.

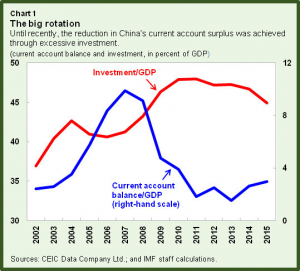

Until 2011, the reduction in the external imbalance was reflected in a growing internal imbalance in terms of the rising levels of investment to GDP ratio due to strong fiscal stimulus. Since 2012, however, some headway has been made away from state-led investment to consumption, both private and state, and from manufacturing to services, with a major bounce in 2015. Consumption now contributes more than 2/3 of GDP growth.

At the same time, however, surging credit usage has become China’s Achilles heel with credit intensity, the amount of new lending provided for each additional unit of output, more than doubling since the global financial meltdown. In addition, while energy intensity of industry has fallen, air pollution remains stubbornly serious as is income inequality even though labour’s share of GDP has steadily grown.

This week, in its marathon bid to rein in high levels of corporate debt, the government announced a set of guidelines that includes encouraging mergers and acquisitions, bankruptcies, debt-to-equity swaps, and debt securitization. The National Development and Reform Commission (NDRC) emphasized only companies with “good prospects” will be allowed to negotiate swaps with lenders. To date, only a handful of insolvent companies have been given the go-ahead to do debt swaps. In recent years, the Chinese authorities have pledged to introduce more market competitive mechanisms into the lumbering SOE sector and shut down ‘zombie companies’ that are kept alive through easy loans from state banks.

Lian Weiliang, deputy chairman of the NDRC told reporters, “market-oriented debt conversion is by no means a free lunch. The relevant market players will make their own decisions, take their own risks and enjoy the benefits. The government takes no responsibility for bailing out losses.”

The government will combine deleveraging with over-capacity reductions and provide preferential tax relief for firms to cut debt levels. As well, the People’s Bank of China (PBoC), China’s central bank, will adopt favourable monetary policies as it pushes banks to transfer bad loans to asset management companies and encourage securitization of bad assets. As this policy package was announced, the central government also resolved to improve market access for foreign companies. In the future, with the exception of certain sensitive industries that are strictly off-limits, foreign investment would only require registration as opposed to approval.

In the backdrop of the recent economic rebound, analysts at US investment bank Morgan Stanley revised their forecast of China’s GDP growth this year to 6.7% from 6.4% and 6.4% from 6.2% for 2017. Moreover, Bloomberg’s survey of 58 economists at the end of September also pegged their expectations at 6.6%, reflecting growing optimism among foreign analysts. In this respect, China must maintain +6% growth to the end of the decade if it wishes to double incomes to US$10,000 by that time. By this writer’s calculation, average incomes should reach $11,000 by end 2020 if the economy can maintain 6.5% growth throughout the decade.

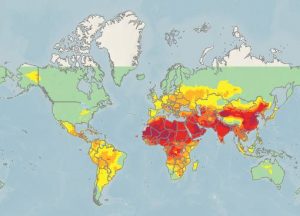

China’s Air Still Among the Worst But Canada Among the Best: WHO air quality model

A new WHO air quality model confirms that 92% of the world’s population lives in places where air quality levels exceed WHO limits. Information is presented via interactive maps, highlighting areas within countries that exceed WHO limits.

It also represents the most detailed outdoor (or ambient) air pollution-related health data, by country, ever reported by WHO. The model is based on data derived from satellite measurements, air transport models and ground station monitors for more than 3000 locations, both rural and urban. It was developed by WHO in collaboration with the University of Bath, United Kingdom.

“WHO’s Ambient Air quality guidelines” for annual mean of particulate matter with a diameter of less than 2.5 micrometres (PM2.5) are 10 μg/m3 annual mean. PM2.5 includes pollutants such as sulfate, nitrates and black carbon, which penetrate deep into the lungs and in the cardiovascular system, posing the greatest risks to human health.

Toronto to Host the Largest Ever Travel Delegation from China to Canada

Toronto will host the largest travel delegation ever to come from China to Canada. The Chinese incentive travel group, NU Skin Greater China, will send 6,000 of its elite salespeople to Toronto in 2018, following a signing ceremony held this week in Shanghai between NU Skin officials, Tourism Toronto and the Ontario Minister of International Trade. This travel program is estimated to generate $8.3 million in visitor spending in Ontario.

This coveted win is part of Tourism Toronto’s multi-year strategy to attract both leisure and corporate travellers from China, which remains the largest overseas market for tourism. In 2015 alone, 260,000 visitors arrived from China, a figure that has doubled since 2010.

– PRNewswire

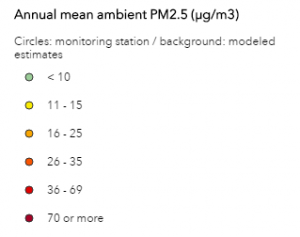

China’s Burgeoning Middle Class Spending

Unbeknownst to the average North American reader, China’s transition to a consumption-led economy has been going on for years. This has led to the burgeoning of a middle class that is progressively cosmopolitan and happier to part ways with hard earned cash in contrast to the previous thrifty and savings-obsessed generation.

Defining China’s middle class as urbanites earning US$9,000 to $34,0000 a year, management consultancy McKinsey and Co. recently projected it will account for 76% of the country’s urban population by 2022, a massive expansion from the tiny 4% in 2000. Last year, China’s urban population approached 730 million or a little over 54% of the entire population which is estimated to expand by one percentage point a year through the 2030s. Even if China’s cities stopped growing, the middle class would still equal 550 million people in seven years, almost 3.75 times America’s whole working population.

More important, the middle class in China is becoming richer in comparison to stagnant middle class incomes in the US and other Western countries. In 2012, China’s “mass” middle class earned $9,000 and $16,000 but within a decade from that date, 54% of Chinese urbanites will be considered “upper middle” class, earning $16,000 to $34,000 a year. That might seem miniscule compared to upper middle class incomes in the US, but adjusted for purchasing power parity (PPP), it means a major jolt in consumer spending.

In a similar analysis, the Boston Consulting Group projected Chinese consumption to grow 9% a year until at least 2020 and China’s consumer economy as a whole by 55% to $6.5 trillion from $4.2 trillion last year, based on the conservative setting of China’s GDP growth at 5.5% per annum even though this year’s growth is expected to fall within 6.5% to 6.7%. In addition, Chinese household debt-to-GDP ratio is less than half of US households that currently stands at around 40%. Not only does this mean Chinese consumers spend far less on servicing debts but also that they’re able to take on more debt, if they choose to do so. Culturally and traditionally, however, Chinese families possess a deep aversion to bank debt, preferring to purchase cars, homes, children’s education, and other major outlays with cash or money borrowed from relatives.

A Goldman Sachs report a year ago described the changing patterns of spending among Chinese consumers. Currently, Chinese families spend on average $7 a day, half on food, compared to $97 a day in the US but as disposable incomes rise, Chinese families will spend more on eating better, dressing nicer, living more comfortably, using more smartphones and cars, having more fun, and spending more on well-being, health, and children’s education. While Chinese consumers prefer to spend more on clothes and food, Goldman Sachs expects them to dig into their pockets for more ‘fun’ – going on vacations at home and abroad, dining out more, and seeking more entertainment and cultural attractions. Currently, Americans spend some 17% of their disposable incomes on having fun whereas Chinese splurge only 9%.

One conspicuously spendthrift group is China’s millennials, those born in the mid-1980s and after. They take trips overseas on a whim, buy stuff more impulsively, and hardly saves at all, much to the chagrin of their parents. A contributor to Forbes magazine writes Chinese millennials are able to keep up their spend-happy ways due to two factors that make their American counterparts envious. First, they are not encumbered by massive student loan debts plus compound interest which American millennials often take decades to pay back, if they haven’t declared bankruptcy already. Chinese millennials enjoy the luxury of their parents paying for their educations which according to Tuition.io averages around $2,200 per year, substantially less than in the US and affordable for most families. In the US, there is a whopping $1.3 trillion in outstanding student loans and more than seven million borrowers in default with tens of millions more struggling to repay.

Second, closely linked to their aversion to household debt coupled with the lack of investment options, Chinese families often plough their funds into acquiring homes with many owing multiple properties that explains to a large extent China’s inability to rein in real estate bubbles across the country. Looking out for their offspring, Chinese parents often hand over an extra apartment that saves millennials immense costs associated with securing a home on their own. By comparison, in the US, millennials, already loaded down with student loans, can hardly afford to rent decent apartments, let alone considering to buy a home. This also explains why millennials in the West travel less and spend far less on the trips they do take than their Chinese counterparts.

By 2020, Chinese millennials will top 300 million (compared to 80 million in the US) who, unlike their parents that are fixated with famous brands and acquiring properties, will form the second generation of Chinese consumers. This group desires to be more spiritually and culturally fulfilled, venturing overseas to expand their horizons and living for the moment. While many will still follow the crowd on group tours, the adventurous minority will want more individualized experiences, preferring to explore sites off the beaten path. And many will continue to indulge in luxuries while others focus on family and children, less burdened by mortgages and car loans like their Western brethren.

Not to be forgotten, a final mainstay of China’s consuming horde is the increasing legions of the elderly. Another recent study by McKinsey & Co. builds on the findings of a previous analysis in 2011 (here I focus on the elderly). The authors state that five years ago, they had grossly underestimated the speed and force of spending by the Chinese elderly. Much of what they had anticipated would happen in 2020 already started happening in 2015. 52% of the 55-65 age group expressed preference for premium products as compared to 32% in 2012 and constituted the group most likely to trade up in their buying habits. They no longer shun famous brands, do not shy away from indulgences, and have grown more accustomed to researching their purchases online.

The Chinese middle class has come into its own and we’re witnessing only the start of China’s ever expansive, changing, and increasingly sophisticated consumption trends that bode well for major surges in imports from abroad.