Canadian Ambassador: China to Invest More in Canadian Mining and Forestry

Canada’s ambassador to China says money from the Asian country is likely to keep pouring into Canadian resource projects.

But Guy Saint-Jacques also says he thinks those dollars will increasingly flow into mining and forestry as well as energy development.

“I expect that the interest will increase on the mining side,” he said in an interview with The Canadian Press after speaking to an audience at the University of Alberta on Monday.

“What I expect also is maybe they will start to get interested in the forestry sector. There’s already investment in pulp manufacturing. I think they are starting to look at potential minority participation in a number of companies.”

Chinese state-owned companies have already staked out a significant foothold in Alberta’s oilpatch — especially in the oilsands after the federal government approved a $15-billion takeover of Calgary-based Nexen by China National Offshore Oil Corp. late last year. PetroChina has also expressed interest in owning a share of the proposed Northern Gateway, which would ship oilsands bitumen to waiting tankers on Canada’s West Coast.

The amount of Chinese money flowing into energy development is still three times the size of the amount going into mining. But Saint-Jacques, a fluent Mandarin speaker who was appointed ambassador last fall, said that country is looking at other resource opportunities as well.

A Chinese-controlled company now has a plan in front of northern regulators to build major open-pit lead, zinc and copper mines along Canada’s Arctic coast.

There is Chinese interest in northern Ontario’s Ring of Fire mining region and in Saskatchewan’s potash reserves as well, said Saint-Jacques.

In his speech, Saint-Jacques pointed out that Canadian mining exports to China already eclipse Canada’s entire exports to Germany.

Forestry exports are also increasing rapidly.

“Our wood exports to China have grown in spectacular fashion; in fact, 22 times between 2002 and 2012.”

The Chinese, who haven’t traditionally built homes from wood, are beginning to realize its advantages in terms of construction ease and insulation, Saint-Jacques said.

“There are new applications in terms of wood that are being specifically applied to the Chinese market, (such as) replacing the roof of a four- or five-storey building. If they use trusses they can replace a block in just a week, so it’s more efficient and they can also have better insulation.”

Chinese policy-makers are also getting a better sense of how Canada balances different interests in resource development, Saint-Jacques suggested.

“They have become a lot more sophisticated. In a number of cases they have started to have discussions directly with First Nations. I think they have come to understand what we mean by being good corporate citizens. They have refined their thinking.

– Canadian Press

CWF: Build and Expand Pipelines for Alberta Oil Sands Crude

Pipeline bottlenecks are costing Canada multi-millions a day and the reluctance of Canadians to address shortfalls in efficient oil transport to foreign markets could put western Canada’s oil and gas sector at risk, declares Pipe or Perish, a new report by the Canada West Foundation. Commissioned by the government of Saskatchewan, the report also outlined the economic benefits of proposed pipelines to the west coast, eastern Canada, and the eastern seaboard of the US via the mid-west. This post focuses on the implications of burgeoning Asian markets, especially China’s, for Canadian crude exports.

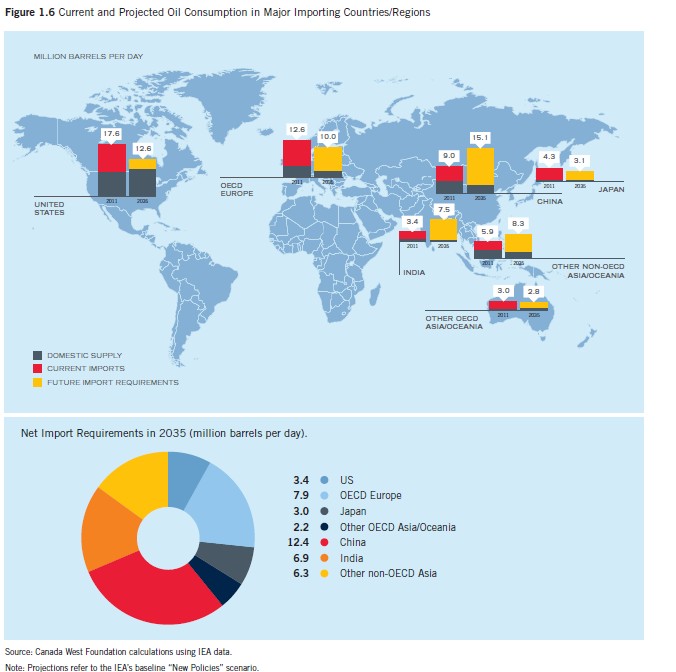

According to International Energy Agency (IEA) world oil consumption scenarios, China is expected to become the world’s largest oil consumer before 2030 and account for half of global growth in oil consumption through 2035. Even in the most stringent ‘450 scenario’ under which China meets emissions targets by 2035 and introduces an escalating system of carbon pricing, her oil demand will not peak for another 13 years (2025). China’s import demand will rise by 153% and other developing Asian markets by 132%.

Eventually, China will need to import more than three times as much oil as western Canada currently produces but Canada has “very little physical access to that market”, the report pointed out. Moreover, going by all long-term supply projections, western Canadian crude production will at least double by 2035. Currently, western Canada has seven major pipelines that transport diluted bitumen, crude oil, and refined petroleum from the region, mainly to the US mid-west.

But, future growth lies in developing Asia, not the US: First, US demand for crude oil and petroleum products is either flat or declining. Add to this booming US production in light of its shale oil and gas revolution that will dramatically reduce American dependency on foreign oil. Further, there is substantial resistance to the oil sands from US environmentalists who have lobbied the Obama Administration hard against the Keystone XL pipeline. Finally, due to pipeline bottlenecks, western Canadian producers are selling oil at steeply discounted prices.

Given the refinery building boom in China, it is more rational for Canadian producers to sell crude rather than refined products, argued the report: “The combination of high capital costs and small per-barrel return on that investment makes bitumen upgrading a risky proposition. Rather than expose ourselves to that risk, many companies are choosing simply to export diluted bitumen to US (foreign) refiners”.

Currently, Kinder Morgan’s Trans Mountain pipeline is the only direct link to the west coast but improving access to Asia via this line is limited because it is only able to deliver 300,000 barrels a day (b/d). Refined products go to BC customers and crude oil to Washington State for refining. Only a tiny fraction lands at the Burnaby Terminal for overseas shipment.

The critical but controversial Enbridge Northern Gateway line from Edmonton to Kitimat would be able to transport 530,000 b/d of diluted bitumen and synthetic crude. Expansion of Kinder Morgan Trans Mountain from Edmonton to Vancouver would add another 590,000 b/d in crude oil and refined products. Together, these two pipelines would be able to transport nearly 1 million b/d of crude to Asian markets. But, the challenge, underscored the report, is “getting these projects approved and completed in a timely manner”.

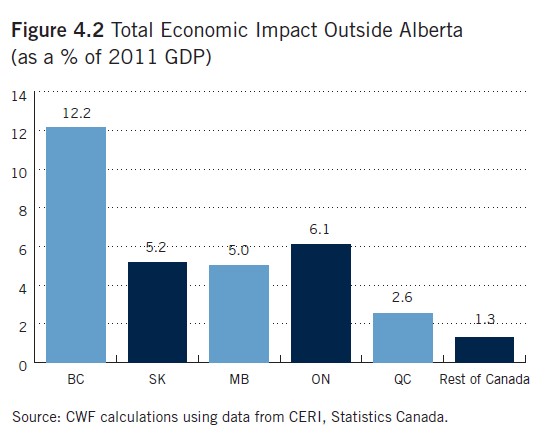

The combined economic impact of extending Trans Mountain and building Keystone XL and Northern Gateway would be immense, Michael Holden, senior economist and author of the report, told the Canadian press: “(if the three pipeline proposals don’t go forward) Canada will be foregoing $1.3 trillion in economic output and 7.4 million person-years of employment and $281 billion in tax revenue between now and 2035”. While the lion’s share of benefits will go to Alberta, an additional $84 billion in economic activity would accrue to other provinces, including $32 billion to other western provinces.  By far, the biggest beneficiary outside of Alberta will be BC which would gain the equivalent of 12.2% in 2011 provincial GDP over the projection period. Combined with other pipeline proposals going east and south, Ontario, Saskatchewan, and Manitoba would enjoy a boost of between 5% and 6.1% in 2011 GDP terms.

By far, the biggest beneficiary outside of Alberta will be BC which would gain the equivalent of 12.2% in 2011 provincial GDP over the projection period. Combined with other pipeline proposals going east and south, Ontario, Saskatchewan, and Manitoba would enjoy a boost of between 5% and 6.1% in 2011 GDP terms.

Infographic: Expensive Foreign Products in China

This is a frequent complaint from Chinese consumers. Hence, their penchant to shop overseas for famous brands. Not-so-famous-brand imported foods are also unreasonably high (tariffs etc. as explained in the infographic). To be fair, price disparities between foreign and Chinese brands can be massive. For instance, at certain Chinese coffee shops, coffee can be as cheap as 8 RMB per cup, using the same beans and espresso machines.

—————–  – business.sohu.com via East-West-Connect.com

– business.sohu.com via East-West-Connect.com

China is Now World’s Biggest Trader

China surpassed the U.S. to become the world’s biggest trading nation last year as measured by the sum of exports and imports, a milestone in the Asian nation’s challenge to the U.S. dominance in global commerce that emerged after the end of World War II in 1945.

U.S. exports and imports last year totaled $3.82 trillion, the U.S. Commerce Department said last week. China’s customs administration reported last month that the country’s total trade in 2012 amounted to $3.87 trillion. China had a $231.1 billion annual trade surplus while the U.S. had a trade deficit of $727.9 billion.

China’s emergence as the biggest global trading nation gives it increasing influence, threatening to disrupt regional trading blocs as it becomes the most important commercial partner for countries including Germany, which will export twice as much to China by the end of the decade as it does to neighboring France, said Goldman Sachs Group’s Jim O’Neill.

China became the world’s biggest exporter in 2009, while the U.S. remains the biggest importer, taking in $2.28 trillion in goods last year compared with China’s $1.82 trillion of imports.

Still, the U.S. economy is more than double the size of China’s, according to the World Bank. In 2011, the U.S. gross domestic product reached $15 trillion while China’s totaled $7.3 trillion.

– Bloomberg

IIAC Chief: Reasons for Optimism on China

Don’t count China out yet, is the message from the president of the Toronto-based Investment Industry Association of Canada (IIAC).

In his latest president’s letter, Ian Russell writes about his recent trip to the sixth annual Asian Financial Forum (AFF) in Hong Kong as head of the Canadian delegation. He outlines four reasons why conference participants anticipate between eight and nine per cent growth for China in 2013:

1. A strong export sector

The expected expansion of the offshore renminbi (RMB) market and the flexibility of manufacturing companies in China will help to strengthen the export sector in the coming year.

The RMB market is a recent innovation that allows foreign businesses to invest in China through RMB-denominated bonds, writes Russell. Speaking at the conference, the chairman of the China Securities Regulatory Commission said that in the coming years this market should increase ten-fold.

This new market will also create opportunities for Canada, writes Russell, as it looks for other financial markets with stable and vibrant currency and derivative markets to do business with.

Exports are also expected to do well, despite a recent decrease in production, writes Russell, because many companies have already moved into higher value-added manufacturing, which should offset rising domestic labour costs. As well, many companies are simply too large and dependent on its trained workforce to move quickly.

2. Domestic consumer demand from a growing middle class

The increasing demand of the 300 to 400 million people in China’s middle class for consumer goods will spur investment in manufacturing and service sectors, writes Russell.

As well as increasing output, this growing consumer demand will help to eliminate production and distribution inefficiencies in various sectors while also raising safety and security standards in industries such as food.

3. Controlled inflation and a calm in housing

The housing market in China has started to cool, writes Russell, and as a result banks are starting to lend again. As such, residential construction could account for 40% of fixed investment in China thereby boosting overall economic growth by a few points.

4. Spending stimulus

Even if the economy slides a little bit there is sufficient confidence that the government will take steps, such as stimulus spending, to help keep the economy afloat, according to Russell.

The AFF is a conference for the global financial business community to discuss and learn about developments and trends in the Asian market. There were over 2,000 delegates at this year’s forum in January.

– Investment Executive

CNNIC: Key Internet Stats

In Jan 2013, China Internet Network Information Center (CNNIC) released its newest(31st) annual report on internet landscape. We translated and summarized some key results below:

-Total 564 million netizens, 42% penetration rate

–420 million mobile users, 74.5% penetration rate among netizens’ population

-Microblogging users amounted to 309 million; dramatic growth period (almost 300% increase from 2010 to 2011) of its user size is over, though maintains around 23.5%.

-The most popular online activities for Chinese netizens ranked by the number of users are instant messages, online search and online music

-The two fastest growing sectors in size of users are online banking (33.2%) and online payment (32.3%)

-The size of online shoppers reached 242 million, increased 24.8% from last year.

– L’Atelier

Kitimat LNG Terminal Approved

The National Energy Board has granted an export licence to LNG Canada Development Inc., a liquefied natural gas terminal proposed by Shell Canada Ltd. and three Asian partners in Kitimat, B.C.

Over a 25-year period, LNG Canada is allowed to export 670 million tonnes of natural gas, which will have been chilled into a liquid state, enabling it to be transported around the world via tanker.

Annually, LNG Canada will be able to export 24 million tonnes of gas.

The federal energy regulator says it’s satisfied that the amount of gas to be exported doesn’t exceed what will be needed within Canada.

The LNG Canada partnership includes Shell, South Korea’s Kogas, Japan’s Mitsubishi Corp. and China’s PetroChina Company Ltd.

They have picked Calgary-based TransCanada Corp. (TSX:TRP) to build a 700-kilometre pipeline connecting prolific shale gas fields in northeastern B.C. to the port of Kitimat.

There are several projects in the works planned for both Kitimat and Prince Rupert, B.C., to export natural gas to lucrative Asian markets.

The North American price of natural gas has been depressed in recent years, as advances in drilling techniques unlock huge supplies from shale formations across the continent, leading to a supply glut.

Companies hope by connecting that fuel to higher-demand Asian markets, their product will fetch a much better price.

– Canadian Press

CBoC: “Walk the Silk Road”

Walking the Silk Road, the title of the Conference Board of Canada’s (CBoC) latest report is indeed evocative. While the US remains Canada’s largest trading partner and will continue to be, emerging (or I should say re-emerging) markets, especially China, are taking an increasing share of both Canadian exports and imports. Canadian businesses must therefore march vigorously down the road to China and other Asian countries in the decades to come, urges the CBoC.

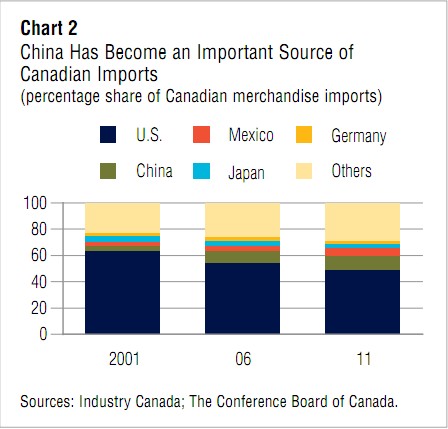

Within a decade, Canadian merchandize heading south of the border has dropped a full 13% from the peak of 87% in 2000-2001 just as China and the UK have seen big increases. Likewise, in the same period, Canadian imports from the US slid from 64% in 2001 to below 50% for the first time as China’s exports to Canada more than tripled to become the second-largest source of imports, accounting for 11% of Canada’s total. And these trends are likely to continue.

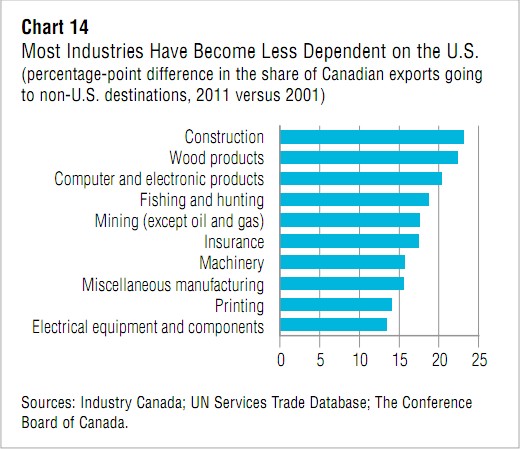

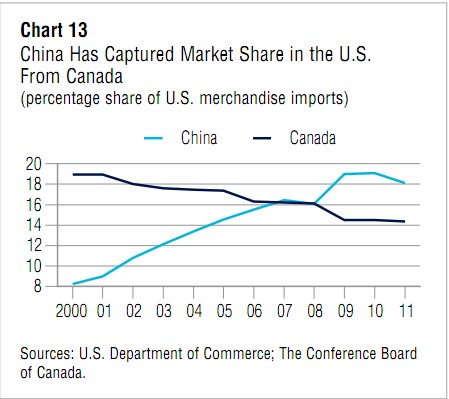

With the exception of communications, mining and miscellaneous manufacturing, Canada’s share of US imports has declined considerably across a range of industries including construction, wood and paper products, forestry and logging, furniture, printing, plastics and rubber, fabricated metal, and others. China, in particular, has steadily taken away that share to surpass Canada as the largest source of the US’s merchandize imports by 2007. Yet, this troubling trend has turned out to be blessing in disguise in driving Canadian businesses to probe new markets around the world.

Canada’s key exports to China include mineral, lumber and pulp, and canola but increasingly new product areas – chemicals, machinery, and aerospace. The same can be said of computers and electronics and services such as insurance in which well known Canadian brands Manulife and Sun Life are expanding aggressively in China and other parts of Asia. So much so that although Canada maintains a large trade deficit with China, that deficit has not deteriorated much since 2008 despite the rising tide of imports from China.

Canada’s key exports to China include mineral, lumber and pulp, and canola but increasingly new product areas – chemicals, machinery, and aerospace. The same can be said of computers and electronics and services such as insurance in which well known Canadian brands Manulife and Sun Life are expanding aggressively in China and other parts of Asia. So much so that although Canada maintains a large trade deficit with China, that deficit has not deteriorated much since 2008 despite the rising tide of imports from China.

CBoC draws some conclusions that are no-brainers: While the US continues to be Canada’s largest trading partner, Canadian companies are increasingly focusing on high growth markets in BRIC countries China, Brazil, and India. Therefore, trade negotiations with these countries will become much broader and of higher priority in the years ahead. Canada is also shifting away from traditional strengths in manufacturing to professional services and natural resources, both sectors in which China plays a major role.

At the same time, “trade between Canada, the US, and China is evolving toward a new and dynamic equilibrium based on trade specialization. Therefore policy should be focused on adaptation and promotion strategies rather than on protection”, underscored the authors.

Dovetailing with the CBoC’s conclusions is Emerging Stronger 2013, a generally upbeat survey by the Ontario Chamber of Commerce (OCC). It found that although 51% of Ontario businesses identified the Great Lakes states as the most critical markets over the next 5-10 years, interestingly, nearly as many, 45%, chose China. They recognize the importance of diversifying exports to China but currently only a fraction of Ontario’s exports go here. Close to 80% of Ontario’s exports are bound for the US while only 1.4% go to China and a paltry 0.3% to India. By contrast, Michigan exports 5.3% of its products and services to China.

Of the nearly 2400 businesses and organizations polled by OCC last December, those in eastern Ontario were most worried about the direction of the province’s economy. Jobs and Prosperity Council (JPC) figures show that Ontario businesses are ill-prepared in trade with only 7% of SMEs involved at all. More depressingly, the average value of Ontario SME exports ranks below that of 47 out of 50 US states!

To help turn things around, OCC wants to leverage Ontario’s large diaspora of Chinese and India immigrants to ferret out trade opportunities. In addition, the JPC wants to hold Global Export Forums, the first of which will highlight China and India and other countries of Asia Pacific. But, to my mind, despite such good intentions at the provincial level which are already late in the game, the federal government should be actively pursuing a free trade pact with China on the heels of the one-year old bilateral Foreign Investment Promotion and Protection Agreement (FIPPA).

US’s Campbell on the US ‘Pivot’ and Not Containing China

While I can agree it isn’t ‘containment’ in the Cold War sense, US-China competition, particularly in Asia-Pacific, is the biggest story in international relations for decades to come. It’s not about China displacing the US as the pre-eminent hegemon. It’s all about China finding its rightful place in the world characterized by several major powers.

————————

|

|

“China is predominant in every aspect of political, financial, economic and security relations. India is still a nascent player in Asia.” Kurt Campbell, the Assistant Secretary of State for East Asian and Pacific Affairs, said at the Aspen Institute, a think-tank, on January 29.

By judgments, he said, the lion’s share of the history of the 21st century’s going to be written in Asia, and the United States has to play a role in that history. “To do so, we must be much more actively engaged, not just for one or two administrations, but for several over a period of years, in every element of our strategy and diplomacy, particularly diplomacy, economic and trade engagement, people to people, cultural exchange,” he said.

“Although the military dimension, which is actually quite modest in this regard, has gotten the most attention, this in many respects, I think what has been under-reported generally is that this has been a diplomatic initiative, by and large,” Campbell said.

“There’s lots of questions about should this be called the rebalance or the pivot or the tilt or, something else. I like ‘rebalancing’, and what I like about the term rebalancing is that it suggests a process that’s going to be in continual evolution, which I believe any aspect of Asian policy necessitates. It requires constant fine tuning. It requires listening carefully to what the region tells us and adjusting our approach accordingly,” he said.

Campbell said the U.S. policy towards the Asia Pacific region is not to contain China.

“I have never heard a senior Chinese diplomat in a formal setting describe American policy as containment,” he said, adding both sides recognise that this is a difficult endeavor, that we have to make our way through very complex challenges.

“Each side has to deal with domestic politics, we have to deal with regional concerns, and we have to recognize that it is natural for two strong players to have areas of tension in the relationship.

– Indolink