China and the Illicit Ivory trade

Abiding by the 1989 international ban on the ivory trade, the Chinese government recently destroyed several tons of pristine tusks and works of ivory art to show its commitment to cracking down. But, as revelations last week of collusion between Chinese traffickers, corrupt Chinese officials, civilian and military, African politicians and businessmen, and poaching cartels, the Chinese government needs to come down even harder on trafficking and corruption.

London-based environmental NGO Environmental Investigation Agency (EIA) released a report stating that more ivory is being shipped out Tanzania than any other African country and Chinese criminal syndicates and officials are involved. About a year ago, EIA’s undercover investigators met a “tight-knit group” of smugglers at the Mwenge market in Dar es Salaam, known as a haven for ivory trading. The sellers worked with a group of Chinese “brothers” who had strong conduits to Guangdong province via the port of Zanzibar.

The EIA even discovered that a couple weeks prior to the state visit of President Xi Jinping to Tanzania in March 2013, Chinese ivory buyers bought out the entire market, saying openly that they were for some parties on President Xi’s entourage of businessmen and officials. After President Xi’s plane landed, the buyers had the audacity of bundling the illicit ivory in diplomatic pouches for shipment back to China on the presidential plane. Apparently, for a time, their buying spree led to the doubling of the black market price of ivory to US$700.

The EIA also accused the Chinese navy of complicity, citing the case of Chinese national Yu Bo who was detained by Tanzanian authorities in December 2013. He was attempting to deliver 81 tusks to two Chinese naval officers on an official visit to the Dar es Salaam port. After paying bribes of $20,000 at an initial checkpoint, he was caught at a second and subsequently sentenced to 20 years for which he has since appealed. One trader bragged he made US$50,000 on a deal with the naval personnel. A month earlier, three Chinese nationals were arrested after a raid on a house in a Dar es Salaam suburb uncovered 706 tusks.

The report similarly pointed to intimate involvement on the part of prominent Tanzanian politicians and businessmen, a secret list of which was submitted to President Jakaya Kikwete by intelligence sources. So far, however, none has been prosecuted due to strong ties to the ruling party. For instance, certain shipping companies implicated in major ivory seizures are run by Abdulrahman Kinana, Secretary General of the Chama Cha Mapinduzi ruling party, but he remains untouched.

Quoted by the Guardian newspaper, EIA executive director Mary Rice said, “This report shows clearly that without a zero tolerance approach, the future of Tanzania’s elephants and its tourism industry are extremely precarious…The ivory trade must be disrupted at all levels of criminality, the entire prosecution chain needs to be systematically restructured, corruption rooted out and all stakeholders including communities exploited by the criminal syndicates and those on the front lines of enforcement given unequivocal support…”

Tanzanian Foreign Minister Bernard Membe denied the report as “…fabricated…to tarnish the image of our country and our friend, the Chinese nation.” Although Chinese Foreign Ministry spokesman Hong Lei labeled the report “baseless”, he did add, “(the Chinese government) attaches importance to the protection of wild animals like elephants (and) we have been cooperating with other countries in this area.” Earlier this year, Mr Lu Youqing, Chinese Ambassador to Tanzania, lamented the role of Chinese nationals in the illicit trade, remarking, “our bad habits have followed us”. (quoted in the Guardian)

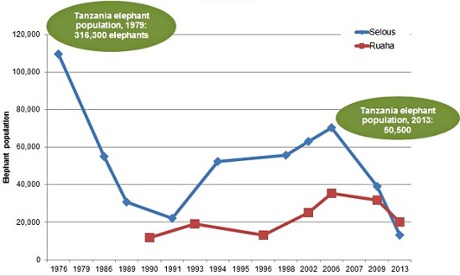

The number of African elephants has dwindled from an estimated 1.3 million in 1979 to about 419,000 today, said the EIA. Southern Tanzania’s Selous reserve, a hotbed of ivory poaching, has seen its elephant herd plummet from about 70,000 heads in 2006 to 13,000 last year. In the whole country, there were 142,000 elephants in 2005 but by next year, when President Kikwete is expected to leave office, the population will have dropped to around 55,000.

Whether the report is accurate and credible remains to be seen and in spite of international sanctions against trafficking, Chinese fondness for ivory carvings along with the handicraft industry supplying it will not diminish any time soon. Celebrities such as former NBA superstar Yao Ming have campaigned tirelessly against the poaching of elephants for ivory, rhinoceros for horns, and sharks for fins. But, in the protracted war against illegal ivory, Chinese authorities must be more vigilant to prevent perpetrators getting away with crimes from under their noses.

Canada Second Cleanest but China Still Very Corrupt: Trace Matrix Survey

The Western press routinely lambasts China for being corrupt and plagued with pervasive bribery risks for businesses, often suggesting that China’s political system is at fault and the transformation to electoral democracy as the panacea.

If you’re into rankings of ‘corruptness’, the Trace Matrix ranking of bribery risks in 197 countries across the globe (developed in collaboration with the Rand Corporation) that came out yesterday has Canada smelling pretty rosy, placing very high up in second with a score of 22, just behind world beater Ireland (score of 20). The lower the score, the cleaner the economy.

A cursory look at the ranking reveals a number of probable variables determining ‘corruptness’ versus ‘cleanness’ (this author’s assessment): 1) it seems to be correlated to a large extent with the level of economic development of countries; the more developed, the less corrupt; 2) corruptness tends to be more prevalent in countries with older civilizations that did not undergo democratic/capitalistic transformations on their own or were colonized such as China, India, Egypt to just name a few; and 3) with the exception of the Japan, Germany, and the US, the size of the economy and population matters with smaller, less complex but nonetheless sophisticated and therefore easier to manage countries tending to be ‘cleaner’. In this respect, Nordic countries seem to fair very well.

In terms of the Sinosphere, China placed very poorly on the index at 137th spot (score of 66) but Hong Kong SAR tied for 3rd with New Zealand and Sweden with a score of 23 and ethnic Chinese dominated Singapore tied for 7th with Japan (26). While Macao scored as bad as the mainland (perhaps due to the gaming industry and the legacy of underworld control), Taiwan was not surveyed. As for emerging market BRICs, China landed behind Russia (134th, score of 65) and ahead of Brazil (145th, score of 69) but way ahead of India (185th with a score of 80).

India is the West’s poster child for mass democracy and is often juxtaposed to China for its boisterous and chaotic politics as opposed to one-party authoritarianism. Yet, in various ratings of economic development, indicators of well-being, and corruption, India consistently falls way behind China. So, it seems that differences in political system exert little impact on results. It comes down to being mainly a function of economic development and market sophistication, competency of government at various levels, levels of transparency, and the government’s commitment to fighting corruption. The massive and successful anti-corruption campaign undertaken by President Xi Jinping’s forces is a case in point which is hardly possible in a polity such as India’s.

The ranking can be found at: http://www.traceinternational.org/trace-matrix/

Here’s a related G & M article: http://www.theglobeandmail.com/report-on-business/international-business/canadian-businesses-among-least-corrupt-survey/article21532628/?cmpid=rss1

In Beijing, Obama Calls ETIM “Terrorists”

In Beijing for the APEC Summit, President Obama toned down somewhat his Administration’s double-talk on East Turkistan Islamic Movement (ETIM) terrorism in Xinjiang but still couldn’t help himself from lecturing his hosts. Nonetheless, it’s a step in the right direction that he did come out explicitly and clearly on ETIM whose membership is predominately from the Uighur ethnic group. Over the past year, Uighur Jihadi extremists have killed a couple hundred police and the general public through knife and explosive attacks across Xinjiang and in key cities around China.

Of course, Obama is only doing so because he needs Chinese help in the fight against Jihadis, especially the ultra-violent and sadistic ISIL.

US President Barack Obama named a shady group linked to attacks in mainly Muslim Xinjiang as he called for cooperation with Beijing on anti-terror efforts in a Xinhua News Agency interview.

Beijing regularly blames an organization it calls the East Turkestan Islamic Movement for a series of deadly attacks in the western province, home to the Uygur minority. Violent attacks and clashes in and related to Xinjiang over the past year have claimed over 200 lives

“Terrorist groups like ETIM should not be allowed to establish a safe haven in ungoverned areas along China’s periphery,” Obama said.

Greater cooperation would depend “on actions China takes at home.

“As nations, we cannot confuse violent extremism with peaceful dissent.

“A failure to treat people equally or respect rule of law or universal rights can sometimes push people into the ranks of terrorist groups.

“Upholding these rights and the rule of law can often be one of the most effective long-term weapons against terrorism,” he added.

But he said China and the US could cooperate “in stemming the flow of foreign terrorist fighters and cracking down on terrorist funding networks.”

– AGENCE FRANCE-PRESSE

Canada Swaps Its Dollar for RMB, Bypassing the US Dollar

Of the 20 odd deals and agreements reached at the heels of Prime Minister Harper’s meeting with his Chinese counterpart Premier Li Keqiang last weekend, by far the most important in terms of the potential for profoundly boosting Canada-China trade was the pronouncement of a 200 billion RMB yuan (C$37.24 billion) currency swap deal between the two central banks. Swapping Canadian dollars for the RMB cuts out the middle currency which in most trade related cases is the US dollar. In so doing, Canada becomes the first country in the Western Hemisphere to become a RMB clearing center.

Although the MoU did not indicate how long the swap would last, China’s central bank, the People’s Bank of China (PBoC), announced last Sunday that the Industrial & Commercial Bank of China (ICBC), China’s largest bank by assets, was designated the RMB-clearing bank, beating out other major players like the Bank of China and the China Construction Bank. Canadian financial institutions were also granted a 50 billion RMB (C$9.31 billion) quota to invest in China’s capital markets under the RMB Qualified Foreign Institutional Investor (RQFII) program.

Since December 2008, China has reached currency swap agreements with 28 countries worth 3.113 trillion RMB but Hong Kong remains the main offshore market for the yuan along with Macau, Taiwan, Singapore, UK, Germany, South Korea, and now Canada. In Canada, the race is on between Toronto and Vancouver for the title of RMB clearing hub city but all indications point to Toronto enjoying a significant lead.

As of August this year, more than 10,000 financial institutions across the globe are dealing in RMB, up 11 times from a mere 900 only three years ago. In terms of trade volume, in 2010 just 3% of China’s trade was settled in RMB but now it is close to 20%. Yet, globally, only about 1.5% of payments are settled in RMB ranking the yuan 7th among the most traded currencies in the world.

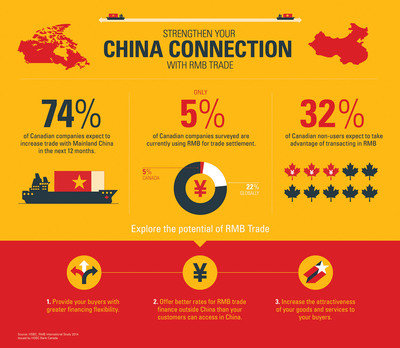

In advance of Harper’s visit to Beijing and Hangzhou ahead of the APEC Summit, the Canadian Chamber of Commerce (CCC) released its major study “Doing More Business with China: Why Canada Needs a RMB Hub” stating, not surprisingly, Chinese companies preferred to transact in their own currency. However, a survey of 11 countries conducted by the HSBC Bank last spring showed Canadian companies as the least likely to use the RMB. Last year, Canada exported some $20 billion to China and imported $52 billion.

The Financial Post reports that Canadian exports to China consist mainly of highly competitive commodities with thin margins such as wood products, iron ore and coal. Selling such goods directly in RMB gives Canadian companies an edge and taking goods in RMB translates to savings for Canadian consumers. The HSBC survey found 55% of Chinese businesses willing to give discounts of up to 5% to traditional partners for RMB-denominated transactions. As a result, British Columbia could see the biggest gains in exports with an additional $9.37 billion over the next ten years.

CTV Calgary quotes Todd Hirsh, chief economist at ATB Financial, as saying that the swap agreement should lend Canadian smaller businesses a helping hand. “If you’re a smaller company and you don’t have that same sort of buying power in a foreign currency, you are going to lose a little bit more each time you trade from Canadian dollars and then US dollars to the Chinese yuan,” he commented.

Benefits would also accrue to the Canadian financial sector in a big way such that institutions would be able to offer portfolios of RMB products to their customers as well as clearing and settling transactions in Canada without using subsidies. The CCC report estimated that by circumventing the US dollar in RMB transactions, Canadian companies could save as much as $6.2 billion over the next decade. In addition, for Canadian capital markets, companies could raise funds in RMB and investors would have opportunities to buy Chinese securities.

The CCC endorsed the arrangement as a crucial step in enhancing Canada-China trade, not to mention reinforcing Canada’s overall relationship with China. Interviewed by Reuters, Hendrik Brakel, a senior economist at the CCC, related: “This is the best and most effective way to boost trade with China. Right now almost all of Canada’s trade with China is (US) dollar denominated. So just the foreign exchange savings from being able to convert directly into yuan, without going through the intermediation of US dollars, that is a big savings in terms of conversion costs alone.”

Janet Ecker, President and CEO of the Toronto Financial Services Alliance (TFSA), said in a press release which claimed her organization as instrumental in initiating talks over the deal between industry and government officials, said, “not only will this initiative help facilitate increased investment and trade and strengthen Canada’s broader economic relationship with China, it will also continue to raise the Toronto region’s stature as a global financial center.”

RMB payment figures are not available for Canada but analysts believe RMB use holds huge potential here. A Chinese asset manager in Hong Kong said, “Canada has more potential in the short term as the US does not want the dominant status of the dollar to be challenged, which is what the Chinese currency is trying to achieve.”

According to global transaction services organization SWIFT, RMB payments in the US increased by a whopping 327% in April from a year before, ranking it third globally in RMB payments value, excluding China and Hong Kong.

Candu – CNNC Tie-Up Great for Canada-China

In spite of calls by various groups for Prime Minister Harper to call out his hosts on so-called ‘human rights’ issues during his recent trip to Beijing, this is the sort of tangible Canada-China cooperation that generates jobs and technological cooperation, and promotes general progress in both countries. It is also what Canada needs to do to better crack the rapidly expanding Chinese marketplace. This particular tie-up helps China to recycle used fuels of its massively growing cluster of nuclear power plants and in so doing dramatically reduces the hazards of conventional nuclear waste.

So, enough of the rhetoric and more of concrete cooperation!

…Candu Energy – divorced from the federal government and in the hands of SNC-Lavalin Group Inc. – says it is working toward a deal that could see it partner with a Chinese nuclear giant to build new reactors, both in China and abroad.

By June, 2015, Candu hopes to finalize a joint-venture deal with China National Nuclear Corp., the massive state-owned atomic power and weapons company, “to develop global opportunities” for its advanced fuel reactor. The two sides signed an initial broad-strokes memorandum of understanding during the visit of Prime Minister Stephen Harper to Beijing this weekend.

In the past week, a technical committee led by CNNC also gave its approval to the technology Candu intends to use, classifying it as a third-generation nuclear system that can meet post-Fukushima safety requirements.

…

The joint venture would be the first between a foreign company and the Chinese nuclear giant to cover development of a technology; competitors such as Westinghouse and Areva have typically signed more limited deals that cover, for example, engineering or equipment supply. Candu has agreed to provide some of its intellectual property, while CNNC will further invest in the technology.

The deal covers a Candu reactor that can be used to burn both recycled uranium and fuel derived from thorium, a more common radioactive element that China has in large quantities. Recycled uranium has already been used to generate electricity through other types of reactors, before being reprocessed into a form that can be used in Candu’s reactors, which can operate with less potent fuel.

Candu says one of its reactors can be built to burn fuel recycled from four existing units. China operates 22 reactors – the most of any country – and is building another 26. Candu has yet to run an entire reactor on recycled uranium, although it has run numerous tests and is modifying its reactors in China for that purpose. It expects to begin “full core conversion” to recycled fuel in late 2015. If that is successful, it opens the door to the potential for multiple installations in China.

– Globe and Mail

Update: China’s New Silk Road Fund Bumped Up to US$40 Billion

An earlier post cited Bloomberg that China would provide 100 billion RMB (US$16.3 billion) toward the New Silk Road fund for infrastructure development along both land and sea routes of the millennia old silk road. Now, Xinhua corrects that China will actually contribute US$40 billion, nearly 2 1/2 times the previous figure.

China will contribute $40 billion to set up a Silk Road infrastructure fund to boost connectivity across Asia, President Xi Jinping announced on Saturday, the latest Chinese project to spread the largesse of its own economic growth.

The fund will be for investing in infrastructure, resources and industrial and financial cooperation, among other projects, Xi said, according to Xinhua.

The goal of the fund is to “break the connectivity bottleneck” in Asia, state media quoted Xi as saying during a meeting in Beijing with leaders from Bangladesh, Cambodia, Laos, Mongolia, Myanmar, Pakistan and Tajikistan.

The Silk Road Fund will be “open” and welcome investors from Asia and beyond to “actively” take part in the project, Xi was cited as saying, ahead of a separate summit of the Asia Pacific Economic Cooperation (APEC) grouping, also being held in the Chinese capital.

Xinhua said it would focus on China’s Silk Road Economic Belt and the 21st Century Maritime Silk Road initiative, which aim to build roads, railways, ports and airports across Central Asia and South Asia.

“Such a framework accommodates the needs of various countries and covers both land and sea-related projects,” Xi said, adding China is ready to welcome its neighbors “to get on board the train of China’s development.”

– Reuters

Queen’s Professor: Stop Demonizing China

Further to the post on the TDSB’s recent cancellation of its hook-up with the Confucius Institute, here’s a compelling commentary by James Miller, Professor of Chinese Religions at Queen’s University. Bravo Professor Miller!

China’s Confucius Institutes provide money and personnel to enable people across the world to learn Chinese and to learn about the Chinese world. Their astonishing success proves that Canadians have an immense hunger to learn about China.

But the demonization of China is a shameful, toxic flaw that runs deep in Canadian history and culture. It prevents rational discussion about Chinese culture, religion and politics. It prevents sensible engagement with the Confucius Institute program. It shamefully hinders the engagement of Chinese Canadians in our civic life, for who would dare subject themselves to the same treatment that Olivia Chow received?

In the end the only victims will be our children who will simply learn to repeat the same flaws and failures of their parents.

France to Help China Hunt Corrupt Officials

Further to a previous post urging Canada to sign an extradition treaty with China and applauding Australia’s recent decision to help Chinese graft busters prioritize the apprehension and extradition of fugitives and seizing their assets in Australia, France has joined the fight against Chinese criminals hiding their families and assets in that country. An extradition treaty with France is awaiting ratification by the French parliament.

The French government will assist the Chinese judiciary by confiscating the illegal assets many corrupt officials have transferred to France, a senior official from the French Ministry of Justice has said. France and China will share the seized funds.

Robert Gelli, director of the criminal affairs Department of the French Ministry of Justice, said that in the following weeks the ministry will strengthen cooperation with its Chinese counterparts to track down corrupt Chinese officials and uncover their transferred funds.

“We will try to locate the ill-gotten funds that Chinese corrupt officials sent to France and take immediate actions to freeze them, such as houses, cars and bank savings and other investments,” Gelli said.

“In addition, for each individual case, we will negotiate with our Chinese counterparts to share the seized funds in a proper proportion,” he said.

In recent years, a number of economic fugitives, including many corrupt officials, have fled to the United Sates, Canada, Australia and European countries such as the Netherlands and France, to avoid Chinese judicial authorities.

Celine Guillet, a senior official from the criminal affairs department of the French Ministry of Justice, said that although a Sino-French bilateral extradition treaty is still waiting for approval by the French Parliament, the two sides will enhance judicial cooperation to nab fugitives and uncover their illegal assets in accordance with mutual legal assistance in criminal matters and other reciprocity regulations.

The judiciary in the US, Japan and Singapore have agreements with other countries to share seized ill-gotten funds and China will sign a formal agreement with Canada to return and share seized assets, he said.

Last month, China and Australia agreed to enhance judicial cooperation on extradition of corrupt officials, according to the Ministry of Public Security.

Australian judicial authorities have a priority list of 100 suspected Chinese economic fugitives and they will conduct joint operations within weeks, according to the Sydney Morning Herald.

By the end of August, China had signed 51 mutual legal assistance agreements for criminal matters and 39 bilateral extradition treaties, according to the Ministry of Justice.

– China Daily

Protests Wreak Havoc on Hong Kong’s Economy: HSBC PMI

In spite of Western media reports trying to prop up the students and insisting their protests exert minimal negative impact on the Hong Kong economy, here is evidence sharply to the contrary. Hardly surprising!

Activity in Hong Kong’s private sector fell by its biggest margin in three years in October, a private survey showed on Wednesday, offering a first glimpse of the impact pro-democracy protests are having on the economy and signalling a further slowdown.

The monthly Purchasing Managers’ index (PMI) in Hong Kong’s private sector compiled by HSBC/Markit fell to 47.7 in October — its strongest pace of deterioration in operating conditions since September 2011 — from 49.8 a month ago.

Sub-indices measuring new orders and output led the decline with a number of companies surveyed attributing the drop to recent political protests that have blocked key roads and hurt business activity for more than a month.

“The slowdown in economic activity in Hong Kong deepened in October as orders and output fell at an accelerated pace,” John Zhu, HSBC’s economist in Asia, said.

A reading above 50 in the business survey indicates an expansion in activity while one below that threshold points to a contraction.

The dismal data is the first set of figures that factor in the impact of pro-democracy protests that have rocked the former British colony.

– Reuters

Chinese Media Face Similar Challenges of Their Foreign Counterparts

This is an interesting article that rather than simply blasting traditional Chinese state media as mouth-pieces of the Communist Party, it reports they face online, financial, and censorship challenges like any other. There are give and takes between them and the government and business bottom lines are unrelenting.

China’s state-controlled media is not being spared the new media challenges facing its Western counterparts, as publications contend with financial challenges and government influence.

An explosion of traditional and online media outlets – all controlled by the government – has flooded the largest media market in the world.

But Chu Xiaoling, deputy chief editor of the Beijing Daily Group, said newspapers were still under pressure to make money and were feeling the pinch of online media.

“We still don’t have a big audience in new media – maybe just five percent of our total readership – but we have seen a 15 to 20 per cent decline in advertising revenue,” she said.

“Right now, our newspapers rely heavily on traditional print advertising revenue [and] advertising in digital media so far isn’t enough to cover our costs.

“We do use social media such as WeChat and Weibo to promote our stories, but we’re yet to see the impact of that and we don’t charge for our online content.”

Despite the financial challenges, the growth in China’s media has also seen a boom in students studying journalism.

Yang Ying, a student at Beijing’s Tsinghua University, said there were financial challenges for those considering entering the media as well.

“The working environment for journalists is quite tough and the pay is not very high,” she said.

“If you want to be a journalist, you have to be a dreamer or something like that.

“There are also restrictions on media in China sometimes.”

Censorship issues affecting current and prospective journalists

With the government controlling all traditional media in China, both current and prospective journalists also feel those restrictions.

Ms Chu said the Beijing Daily Group was in constant contact with government officials regarding the content of the paper.

“From time to time, they may ask us not to publish certain news, but at the end of the day, it’s up to the editor-in-chief,” she said.

“When we cover important issues, we might present those stories to government officials for accuracy and clarification because our newspapers are led by China’s Communist Party.

“We don’t tend to do that with cultural or social stories though.”

Journalism students say the emergence of new media is allowing more access to information and freedom of communication.

Liu Moxiao said all journalists around the world face pressure from the government over their reporting – not just those in China.

“[But] especially nowadays, China’s investigative reporting is thriving and we have many famous investigative reporters who have unveiled big news,” she said.

“China is a big market – it is too big [with] too many news stories, and there are many bad news stories.

“I think journalists are watchdogs all around the world.”

– ABC (Australia)