Canada Swaps Its Dollar for RMB, Bypassing the US Dollar

Of the 20 odd deals and agreements reached at the heels of Prime Minister Harper’s meeting with his Chinese counterpart Premier Li Keqiang last weekend, by far the most important in terms of the potential for profoundly boosting Canada-China trade was the pronouncement of a 200 billion RMB yuan (C$37.24 billion) currency swap deal between the two central banks. Swapping Canadian dollars for the RMB cuts out the middle currency which in most trade related cases is the US dollar. In so doing, Canada becomes the first country in the Western Hemisphere to become a RMB clearing center.

Although the MoU did not indicate how long the swap would last, China’s central bank, the People’s Bank of China (PBoC), announced last Sunday that the Industrial & Commercial Bank of China (ICBC), China’s largest bank by assets, was designated the RMB-clearing bank, beating out other major players like the Bank of China and the China Construction Bank. Canadian financial institutions were also granted a 50 billion RMB (C$9.31 billion) quota to invest in China’s capital markets under the RMB Qualified Foreign Institutional Investor (RQFII) program.

Since December 2008, China has reached currency swap agreements with 28 countries worth 3.113 trillion RMB but Hong Kong remains the main offshore market for the yuan along with Macau, Taiwan, Singapore, UK, Germany, South Korea, and now Canada. In Canada, the race is on between Toronto and Vancouver for the title of RMB clearing hub city but all indications point to Toronto enjoying a significant lead.

As of August this year, more than 10,000 financial institutions across the globe are dealing in RMB, up 11 times from a mere 900 only three years ago. In terms of trade volume, in 2010 just 3% of China’s trade was settled in RMB but now it is close to 20%. Yet, globally, only about 1.5% of payments are settled in RMB ranking the yuan 7th among the most traded currencies in the world.

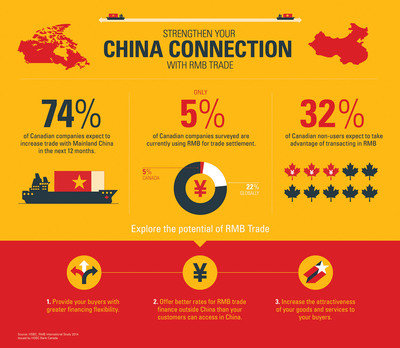

In advance of Harper’s visit to Beijing and Hangzhou ahead of the APEC Summit, the Canadian Chamber of Commerce (CCC) released its major study “Doing More Business with China: Why Canada Needs a RMB Hub” stating, not surprisingly, Chinese companies preferred to transact in their own currency. However, a survey of 11 countries conducted by the HSBC Bank last spring showed Canadian companies as the least likely to use the RMB. Last year, Canada exported some $20 billion to China and imported $52 billion.

The Financial Post reports that Canadian exports to China consist mainly of highly competitive commodities with thin margins such as wood products, iron ore and coal. Selling such goods directly in RMB gives Canadian companies an edge and taking goods in RMB translates to savings for Canadian consumers. The HSBC survey found 55% of Chinese businesses willing to give discounts of up to 5% to traditional partners for RMB-denominated transactions. As a result, British Columbia could see the biggest gains in exports with an additional $9.37 billion over the next ten years.

CTV Calgary quotes Todd Hirsh, chief economist at ATB Financial, as saying that the swap agreement should lend Canadian smaller businesses a helping hand. “If you’re a smaller company and you don’t have that same sort of buying power in a foreign currency, you are going to lose a little bit more each time you trade from Canadian dollars and then US dollars to the Chinese yuan,” he commented.

Benefits would also accrue to the Canadian financial sector in a big way such that institutions would be able to offer portfolios of RMB products to their customers as well as clearing and settling transactions in Canada without using subsidies. The CCC report estimated that by circumventing the US dollar in RMB transactions, Canadian companies could save as much as $6.2 billion over the next decade. In addition, for Canadian capital markets, companies could raise funds in RMB and investors would have opportunities to buy Chinese securities.

The CCC endorsed the arrangement as a crucial step in enhancing Canada-China trade, not to mention reinforcing Canada’s overall relationship with China. Interviewed by Reuters, Hendrik Brakel, a senior economist at the CCC, related: “This is the best and most effective way to boost trade with China. Right now almost all of Canada’s trade with China is (US) dollar denominated. So just the foreign exchange savings from being able to convert directly into yuan, without going through the intermediation of US dollars, that is a big savings in terms of conversion costs alone.”

Janet Ecker, President and CEO of the Toronto Financial Services Alliance (TFSA), said in a press release which claimed her organization as instrumental in initiating talks over the deal between industry and government officials, said, “not only will this initiative help facilitate increased investment and trade and strengthen Canada’s broader economic relationship with China, it will also continue to raise the Toronto region’s stature as a global financial center.”

RMB payment figures are not available for Canada but analysts believe RMB use holds huge potential here. A Chinese asset manager in Hong Kong said, “Canada has more potential in the short term as the US does not want the dominant status of the dollar to be challenged, which is what the Chinese currency is trying to achieve.”

According to global transaction services organization SWIFT, RMB payments in the US increased by a whopping 327% in April from a year before, ranking it third globally in RMB payments value, excluding China and Hong Kong.