Chinese rich are keen to emigrate

Source: China Daily

SHANGHAI – About 60 percent of the rich Chinese people, each of whom has a net asset of at least 60 million yuan ($9.44 million), said they intended to migrate from China, a report has found.

About 14 percent of them have either already migrated from China or have applied for migration.

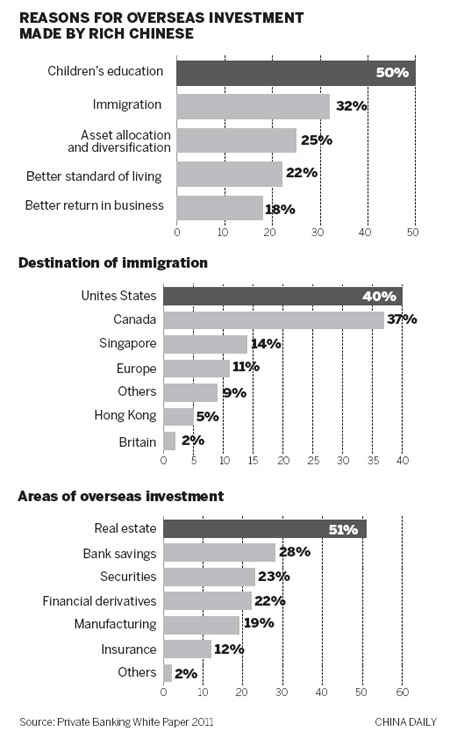

The three most favored destinations by the Chinese rich are the United States, Canada and Singapore. The US is the first choice of some 40 percent of the people interviewed, according to a white paper jointly released by Hurun Report and the Bank of China (BOC) on Saturday.

According to US Citizenship and Immigration Services (USCIS), the number of Chinese applicants for investment immigration has exceeded applications from any other country or region.

Last year, the USCIS issued 772 EB-5 visas, meant for investor immigrants, to Chinese people. They account for 41 percent of the total EB-5 visas issued by the agency.

“Among all the destinations in terms of investment immigration, the US always outstand all other options as the country does not impose any quota,” said Jiao Lingyan, a client executive of the investment immigration department of the Beijing-based GlobeImmi International Education Consultation Co.

“The minimum amount required for investment immigration to the US is $500,000. But it should be noted that this applies to investments in projects recommended by authorities in the US. People considering these projects should take into account that they may not make profits,” Jiao said.

“It is worth noting that the minimum amount for investment immigration will be raised in the coming years, because the number of rich people in China is rapidly growing,” she said.

Among the 980 people interviewed by Hurun Report and the BOC, one-third said they have assets overseas, which on an average account for 19 percent of their total assets.

While 32 percent of the interviewees said they have invested overseas with a view to immigrate, half of them said they did so mainly for the sake of their children’s education.

Zhang Yuehui, a Beijing-based immigration expert, said children’s education is also the top concern among those who want to immigrate.

“A growing number of parents in China have realized that children growing up in the examination-oriented education system in China will find it hard to compete in an increasingly globalized world,” Zhang said.

Wang Lilan, 38, a mother of two who immigrated to Australia from her home province of Fujian two years ago, was one of those parents.

“My 12-year-old elder daughter used to do her homework very late into the night. But here in Australia, she does quite a lot practical assignment, in a playful way. And she has more spare time to do the things she likes,” Wang said.

“I feel very delighted to see my children having fun while studying,” Wang said.

Chinese immigrants are also getting younger, with the largest group aged between 25 and 30, compared to the 40-45 age group in the past, Zhang said.

SHANGHAI – Having decided to move to Los Angeles with her husband, expecting mother, Xu Cong, 25, has been busy preparing the immigration documents and plans to leave for the United States in December.

“I’ve discussed our future with my husband and we reached the conclusion that if we want to provide better education to our children and have more career choices for ourselves, immigration is the best solution,” said Xu who studied in Britain for five years from 2003 to 2008.

They come under a category different from investment immigration, where applicants have to invest at least $500,000 in a targeted employment area to get a visa. Xu and her husband said they chose to register their own trading company by putting at least $800,000 as the starting fund.

According to the US Citizenship and Immigration Services, targeted employment area refers to a high-unemployment or rural area in the US. The minimum qualifying investment in such cases is $500,000.

Xu’s company will import gloves from China to the US and export water purifier and medical devices from the US to other countries.

In accordance with the rules set by the US Citizenship and Immigration Services, Xu also needs to create or preserve at least 10 full-time jobs for qualifying US workers within two years.

“The whole process of preparation is more complicated than we thought, especially we have to write the detailed business plans for the company on how to make enough profits,” she said.

Xu and her husband decided to move their date of arrival in the US forward, from March next year to December this year, to make sure that their baby will be born in the US.

“My children will receive better education and we will work for our company in the US Our parents will also be able to move to the US and live with us,” said Xu.

The Best Countries For Business

Source: Forbes

http://www.forbes.com/sites/kurtbadenhausen/2011/10/03/the-best-countries-for-business/

During the run-up to every U.S. presidential election, countless Americans threaten to move to Canada if their preferred candidate does not emerge victorious. Of course, few follow through with a move north. Maybe it is time to reconsider.

Canada ranks No. 1 in our annual look at the Best Countries for Business. While the U.S. is paralyzed by fears of a double-dip recession and Europe struggles with sovereign debt issues, Canada’s economy has held up better than most. The $1.6 trillion economy is the ninth biggest in the world and grew 3.1% last year. It is expected to expand 2.4% in 2011, according to the Royal Bank of Canada.

Canada skirted the banking meltdown that plagued the U.S. and Europe. Banks like Royal Bank of Canada, Bank of Nova Scotia and Bank of Montreal avoided bailouts and were profitable during the financial crises that started in 2007. Canadian banks emerged from the tumult among the strongest in the world thanks to their conservative lending practices.

Canada is the only country that ranks in the top 20 in 10 metrics that we considered to determine the Best Countries for Business (we factored in 11 overall). It ranks in the top five for both investor protection as well as lack of red tape, which measures how easy it is to start a business.

Full List: The Best Countries For Business

Canada moves up from No. 4 in last year’s ranking thanks to its improved tax standing. It ranks ninth overall for tax burden compared to No. 23 in 2010. Credit a reformed tax structure with a Harmonized Sales Tax introduced in Ontario and British Columbia in 2010. The goal is to make Canadian businesses more competitive. Canada’s tax status also improved thanks to reduced corporate and employee tax rates.

Canada leans on the U.S. economy heavily: it’s the biggest oil supplier to Uncle Sam and three-quarters of its exports end up in the U.S. each year. Yet while U.S. unemployment has stayed above 9%, it’s only 7.3% in Canada compared to the 25-year average of 8.5%. The eurozone unemployment rate is 10%.

Forbes leaned on research and published reports from the Central Intelligence Agency, Freedom House, Heritage Foundation, Property Rights Alliance, Transparency International, the World Bank and World Economic Forum to compile the rankings.

Denmark dropped from the top spot in 2010 to No. 5 this year as its relative monetary freedom declined as measured by the Heritage Foundation. Denmark’s stock market also fell 14%, which was the worst performance of any of our top 10 countries. Four other European countries in last year’s top 20 also dropped in the rankings, with Finland sliding to No. 13, the Netherlands to No. 15 Netherlands, Germany to No. 21 and Iceland to No. 23.

The U.S. ranked No. 10, down from No. 9 in 2010. The world’s largest economy at $14.7 trillion continues to be one of the most innovative, ranking sixth in patents per capita among all countries (No.7 overall Sweden ranks tops for innovation).

What hurts the U.S. is its heavy tax burden. This year it surpassed Japan to have the highest corporate tax rate among developed countries. The U.S. also gets dinged for a poor showing on monetary freedom as measured by the Heritage Foundation. Heritage gauges price stability and price controls and the U.S. ranks No. 50 out of 134 countries.

Bringing up the rear are three countries where the economies are smaller than $10 billion. No. 132 Burundi, No. 133 Zimbabwe and No. 134 Chad all fare poorly when it comes to trade and monetary freedom as well as innovation and technology. Chad has the highest GDP per capita of the three at $1,600, but scores last among all countries on both corruption and red tape.We determined the Best Countries for Business by looking at 11 different factors for 134 countries. We considered property rights, innovation, taxes, technology, corruption, freedom (personal, trade and monetary), red tape, investor protection and stock market performance.

Fast says Canada close to investment deal with China, plans trip next week

China trade: A forklift arranges shipping containers near a port in Shanghai, China.

AP file photo

OTTAWA — Canada is closing in on a key trade agreement designed to boost economic ties with China as the importance of the U.S. wanes, says Trade Minister Ed Fast.

Fast told reporters in a conference call from Jakarta on Monday he will be travelling to China next week and that negotiations are nearing a close.

“We’re hoping to complete those negotiations soon and if that happens I think it will increase investment for both of our countries in a very significant way,” he said.

Canada has been seeking a Foreign Investment Promotion and Protection Agreement since 1994, but the process picked up steam recently following Prime Minister Stephen Harper’s first visit to China at the end of 2009. The prime minister is rumoured to be planning a second visit later this fall.

China is the world’s second-largest economy and a major buyer of Canadian resources — from coal and fertilizer to grain and lumber — while Canadian businesses have been seeking a firmer foothold in the world’s emerging economic superpower.

Fast said a new agreement would set the ground rules for firms that want to invest in China and would contain a dispute resolution process.

“I’ve been asked to make Asia a key focus of our work and most of all China,” he said.

“In the long term, Canada is going to have to diversify its trading relationships and that will benefit our long-term prosperity.”

Next week, Fast said he will visit Beijing, Shanghai and four regional centres where Canadian firms have interests. The trade visit will focus on the nuclear industry, natural resources, aerospace and other sectors, he said.

China has been stockpiling minerals, metals, cement, coal and other resources for years to help feed the Asian country’s rapidly growing infrastructure needs.

In the last two years, companies from China have bought a 20 per cent stake in Vancouver-based Teck Resources, Canada’s largest publicly traded miner, as well as expanded in the oilsands sector of Northern Alberta.

Chinese companies have also helped finance iron ore exploration in northern Quebec and other metals projects in the rest of Canada.

A report from CIBC World Markets, released Monday, noted that Canadian exporters are already adapting to the global economy’s shifting centre gravity away from the U.S. and Europe.

The CIBC notes that Canadian exports are currently 30 per cent more diversified than they were a decade ago, with the share of exports to the U.S. — while still at about 75 per cent — back to the level they were before NAFTA. At the present rate, the U.S. share of Canadian exports could fall to 60 per cent by the end of the decade, the report states, with countries like China picking up most of the slack.

“The post-Great Recession era, and the new mix of economic growth that will define it, could provide corporate Canada with a golden opportunity to restructure itself in a way that simultaneously reduces its dependence on the U.S. economy, and improves its bottom line,” the report argues.

While Canadian exports have sharply increased in recent years, China continues to enjoy an advantage in the relationship, exporting more than twice what it takes in from Canada.

As well, China’s trading policies, particularly its low currency, have become a lightning rod of criticism in the U.S. This week, the U.S. Senate is debating whether to impose sanctions in response.

Fast would not comment on possible U.S. action, but said in general he is concerned about the “rise” in protectionist sentiment, adding that “expanding trade with the Asian countries” is in Canada’s interest.

Canada will not back off on its efforts to increase trade liberalization, including talks with the troubled European Community, in the face of the global economic difficulties, he insisted.

The minister’s comments came at the conclusion of a trip to Japan and Indonesia where he concluded four trade agreements, including an Anti-Counterfeiting Trade Agreement and an expanded air transport deal with Japan.

The Canadian Press

Canada’s First Nations turn to China for economic development opportunitie

VANCOUVER – Canada’s First Nations want a piece of the economic pie and they are now turning to China for a better and more prosperous future.

Shawn Atleo, national chief of the Assembly of First Nations, and Clement Chartier, president of the Metis National Council, said Wednesday their organizations are preparing for trips to China to discuss economic development.

The announcements followed a Council of the Federation meeting between provincial, territorial and First Nations’ leaders. Participants agreed to focus on aboriginal education, economic development, emergency preparedness and missing women.

Also on Wednesday, Foreign Affairs Minister John Baird finished a four-day trip to China after meetings with senior government officials and business leaders.

Atleo said his organization made Chinese contacts during a mining and energy summit in Niagara, Ont., about three weeks ago, and he will now lead a trade and political mission to China later this year.

“China expressed an interest in working on trade projects with First Nations directly,” said Atleo, before adding that aboriginals are involved in natural-resource programs worth $300 billion across Canada.

Atleo said First Nations do not oppose development, they just don’t support development at all costs.

Chartier said his organization, too, is planning a trade mission to China and Taiwan.

“It’s an area that we are definitely engaging in and have an interest in,” he said.

British Columbia Premier Christy Clark said while provincial, territorial and First Nations leaders didn’t talk about trade with Asia specifically on Wednesday, they did talk about economic development for aboriginal communities.

Clark said the Asia-Pacific boasts the fastest growing middle class and the fastest rate of urbanization and as a result, has huge employment potential.

In a conference call from Shanghai, Baird said Canada-China relations are warming and can be further improved by face-to-face dialogue.

He said relations between the two countries have entered a new era in recent years and he wants to build on that.

Clark said the premiers also agreed to call a first minister’s meeting, where aboriginal education will be discussed.

She said they agreed to convene another meeting to discuss the hundreds of First Nations’ women who have gone missing across Canada.

Finally, she said the premiers and First Nations’ leaders agreed to help improve disaster mitigation and emergency preparedness in aboriginal communities.

The Conference of the Federation meeting continues Thursday and Friday.

During a short news conference at the RBC Canadian open Wednesday, Clark said the leaders will spend the rest of the week talking about the Asia-Pacific and health care

B.C. lumber exports to China soar

B.C. lumber exports to China soar

CBC – 4 hours ago

….tweet0EmailPrint……Trade figures show the value of softwood lumber

exported to China has surpassed the U.S. for the first time, sending

powerful signals about the importance of the Asia-Pacific markets for

B.C.’s economy and job prospects.

“China has become our most important market for lumber,” said Pat Bell,

the former B.C. Forests minister and the current Minister of Jobs, Tourism

and Innovation.

May was a record-breaking month for B.C. softwood lumber exports to China

with 746,000 cubic metres exported — up 157 per cent by volume over the

same month last year. From January to May, B.C. exported 2.8 million cubic

metres to China, up over double from last year in both volume and value.

“I was shocked,” Bell said. “I had to do the math three or four times to

make sure that I was right.”

He credits the expansion to work by the province and forest industry to

diversify the market for B.C. forest products by expanding into China.

“This is the result of years of hard work by the provincial government and

industry,” Bell said.

“In only five months, we’ve shipped the equivalent of over 76,000

containers of wood to China — the equivalent production of approximately

14 typical Interior sawmills over this period. These shipments represent

family-supporting jobs across the province and the continued success of

our rural B.C. communities.”

Bell — who also represents the Prince George-Mackenzie riding, an area

dependent on its saw mills — said it’s good news for B.C.’s forest

industry.

“Mills are working today directly as a result of China,” he said.

“Ten thousand people are working directly because of Chinese lumber right

now. Across northern B.C., factories say their shipments to China are

exceeding their shipments to the U.S. by four- and five-fold.”

Statistics show China spent $3 million more on B.C. lumber than U.S.

buyers in May 2011, and officials say the value of B.C.’s softwood lumber

exports to all Asian destinations has now surpassed the total value of

shipments to the U.S.

“We continue to see staggering growth in the amount of wood we export to

China, so I’m not surprised that in May we shattered another record for

lumber exports to the world’s fastest growing economy,” said Minister of

Forests, Lands and Natural Resource Operations, Steve Thomson.

“This is great news for British Columbians who depend on the forest sector

for jobs that support their families.”

Bell predicts lumber exports to China will keep rising, but only if Canada

can corral enough rail cars and ships to get B.C.’s lumber overseas.