GAC’s E-jet Grabbing Eyeballs in Motown

Everyone’s focused on the Corvette at today’s North American International Auto Show. But a sleek sports car from China’s is also getting quite a bit of attention.

“It’s got the wow factor,” said one Detroiter as he checked out the car with a group of friends. They admired the blue-lit grille, the race car seats, and the muscled yet sleek exterior of the E-jet. One of them said it was as impressive as the BMW Z4 roadster on display in the main hall.

The car and two others are electric hybrids on display from GAC Group, a diversified Chinese auto manufacturer formally known as Guangzhou Automobile Group Co., Ltd. It is the company’s first time in Detroit—and it also is the only Chinese automaker in an event packed full of Fords, Hondas, Chryslers and Jaguars among others.

Yet one of the Chinese-built GACs, a white five-seat crossover, would look right at home parked at Northland Mall, just north of Detroit, except for the Chinese words on one side of the back bumper.

The company plans to use “new-energy vehicles to enter developed markets,” GAC Motors Group vice president Xiangdong Huang said.

GAC will reveal some of its plans for a move into the United States at a media briefing tomorrow. Staffers told Quartz they do not have dealerships set up yet, and they hope to start US sales as soon as they clear regulatory hurdles. One of them noted that Guangzhou Automobile already was in Australia. About 25 staffers are in Detroit for the US debut.

Like many first-timers to the sprawling auto show in downtown Detroit, GAC was relegated to a small space the front hallway. The other newbie is VLP Automotive, a California carmaker.

The GAC E-jet had several features that stood out. Instead of side mirrors, the car boasts a tiny camera measuring just about an inch across. The finish to the car had a pearly gloss, and the headlights and tail lights wrapped around stylistically yet brightly. One woman said it looked a bit like the Delorean from Back to the Future.

According to GAC’s spec sheet, the E-jet can travel about 100 kilometers (62 miles) on one electric charge and will go 160 kilometers (100 miles) per hour.

GAC staff seemed happy to show off their three cars and pointed out the place in the back seat of the largest, the BEV, for child safety seats. That is the best seller of the models in China, one staffer said. The E-jet is a concept car that will debut in China by around July, another GAC staffer said.

China’s vehicle sales, including buses, could reach 20 million this year, a 5% increase over last year. That compares to an expected 15 million cars and trucks to be sold in the United States in the same time frame, up from 14.3 million last year, analysts estimated.

Some Chinese automakers may not be ready to sell cars in the United States until around 2020 because they need to develop their brands and trust, J.D. Power analyst Jacob George told Reuters. He said: “By 2018, we do see Chinese automakers becoming roughly equal in quality to global automakers, but …you need to have more than just quality.”

– Quartz

Xinci.so: New Online Dictionary of Chinese Slang

So now we’ve figured out that the internet won’t bring universal freedoms to China and got all that disappointment out of our systems, perhaps it can at least bring some lulz. A startup site called Xinci.so wants to help people figure out all the Chinese slang and faddish humor that pervades the web, which often resembles some sort of hyperconnected playground of childish insider gags.

Xinci – which could be translated as “new dictionary” – is basically a version of UrbanDictionary, packed full of user-submitted Chinese slang terms. So far it has 4,000 entries, which is a bit short of UD’s seven million English terms, but it’s a start.

If Xinci can gather a devoted clique of regular uploaders, then the site should become the go-to place for the web’s wisecracks. For those baffled by all the slang, Xinci can inform you that “3Q” is a jokey way of saying “thank you” in Chinese (say it “san q”), or that “ cai niao ” is a “noob”, especially referring to a newcomer on the web. Though if that needs explaining to you, then you’re the noob, obviously.

With UrbanDictionary getting such huge traffic – 15 million visits a month – it might not be a bonehead move to make such a silly site. Xinci’s founder is Jason Gui from mainland China, who’s a graduate of Penn, an Ivy League school, so he’ll have a business plan in mind. Indeed, he told Chinese tech blog 36Kr yesterday that it’s a serious project for him, and he’ll soon start to monetize it. For now, Xinci has no ads and is available in both simplified and traditional Chinese versions, with an English iteration promised.

(Source: 36Kr – article in Chinese)

– Tech in Asia

FP Comment: Benefits of Oil Sands

This comment by David McLellan of Calgary’s Petrobank Energy and Resources Ltd. makes a lot of sense, especially when you compare how much Canadians consume in terms of per capita barrels of oil – 9 times as much as the average Chinese. So, when those hypocrites bash China for this and that, remember how much Canadians consume and take for granted.

——————

Great jobs with environmental issues that are being dealt with

From an economic perspective, Canada currently stands out among its OECD peers. On a relative basis, we have not looked this strong in more than a generation, although it is by no means a given that we will retain this superior economic performance, with so many obstacles facing our historical trading partners.

It will be imperative to capitalize on our natural resource assets in particular, by developing and commercializing advanced technologies to facilitate their development in more economic and environmentally responsible way.

Consider that there is an irrefutable positive correlation between standard of living and energy consumption, proofed by an examination of current global petroleum consumption. The International Energy Agency reported that in 2011, Canadian per-capita annual consumption of petroleum was 24.6 barrels; the U.S. figure was 21.8 barrels, while the Chinese figure was just 2.7 and the Indian figure was a paltry one barrel. It is not unreasonable to assume that the populations of China, India and much of the developing world would be striving to achieve a Western style standard-of-living. It may be unreasonable to think they will get there soon, given their numerous challenges, but suppose they do get to a point where their per-capita consumption of petroleum rises to a level about one-third of North America’s. With populations of 1.35 billion and 1.2 billion respectively, that translates into more than 50 million additional barrels consumed per day, not accounting for growth in demand from the other emerging economies (perhaps being partially offset by declining per-capita consumption in the OECD). Where is the additional oil and gas to come from?

Canada’s land mass has been blessed with a staggering abundance of hydrocarbon resource. The total oil in place is thought to be some 1.7 trillion barrels and we have been assigned reserves of 178 billion barrels (Alberta holding 96% of that), bequeathing Canadians with the third-largest reserves in the world. With the Canadian Association of Petroleum Producers (CAPP) reporting 2011 production of approximately 2.1 million barrels of oil per day, one could argue there is more than a hundred year’s supply, even after a doubling of production, and that is with no material improvements in technology or pricing such that our reserves increase. However one looks at the scale of our resource and the potential effects of new technologies and pricing, one should conclude that there will still be plenty of oil left in Canada long after the world no longer needs it. In 1973 Sheikh Yamani of Saudi Arabia astutely stated that “the Stone Age did not end because the world ran out of stones.” This national endowment should be produced now and over the next 35-plus years while it still has value.

http://opinion.financialpost.com/2013/01/14/the-oil-sands-benefits/

Q & A: China’s Cleantech Revolution

Despite the severe air pollution problems Beijing is facing these past few days, here is a Q & A with a Tyee journalist on China’s green revolution and what it means for Canadian/BC firms.

– China Daily

———————

Late in November Tyee journalist Geoff Dembicki rolled out a widely read series of five reports from Beijing and Canada on the burgeoning cleantech market in China and why doing business there presents special risks and rewards for Canadian firms. The Toronto Star ran a condensed version in its business pages.

You can hear Dembicki discuss his findings when he is hosted in Vancouver by the Asia Pacific Foundation this Wednesday, Jan. 16, at 12 noon. Given British Columbia’s ties to China, those attending the talk will no doubt draw on diverse perspectives in posing questions to the energy beat reporter who spent two months on the project, travel funded by an Asia Pacific Foundation Media Fellowship.

As a preview, we directed a few questions of our own to Dembicki:

What is ‘cleantech’ and why should Canadians care that China is investing billions of dollars to support it?

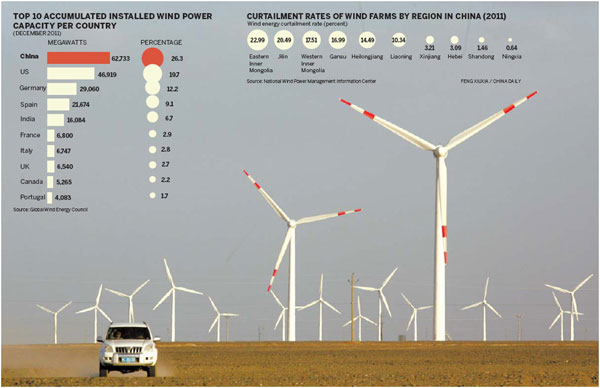

“‘Cleantech’ is shorthand for clean technology. Most people think wind turbines and solar panels. But it actually refers to a huge range of innovations on the cutting edge of humankind’s fight to preserve a healthy planet. China’s massive financial and political gamble on cleantech is restructuring the global economy in ways we don’t yet fully understand. It’s also created gigantic markets for a new generation of Canadian green entrepreneurs.”

Political leaders in Canada and the U.S. often frame climate change as a question of environmental priorities versus the need to maintain a healthy economy. Has China found a new way to resolve that tension?

“What many people don’t realize is that rising labour costs are making it harder and harder for China to be the ‘world’s factory.’ The country’s future prosperity may depend on its ability to create innovative ideas and technology — to go from ‘made in China’ to ‘designed in China.’ Cleantech could provide that bridge. No country has yet figured out how to create a sustainable economy. That makes it easier for China to be a world leader.”

Why is China, a Communist country, pursuing carbon pricing, an inherently free-market policy, so aggressively? And how come Canadian Prime Minister Stephen Harper prefers top-down climate regulations instead?

“China’s first major attempt to improve the country’s energy efficiency was remarkably successful. But it relied on brute-force methods: old factories were simply shut down; in some areas, officials cut off power to entire cities. Carbon pricing potentially offers Chinese industry strong incentives to root out hidden inefficiencies on its own. Harper’s repeated rejection of such a policy confounds many observers. But ultimately it’s a reflection of Canada’s extremely polarized environmental politics.”

It’s hard not be a bit skeptical about China’s commitment to ‘green’ development. This is the same country, after all, that is widely acknowledged to have wrecked the 2009 climate negotiations in Copenhagen. How do you make sense of that contradiction?

“China, along with Canada, was widely perceived as one of Copenhagen’s major villains. That same year, though, China also set one of the planet’s most ambitious climate targets. I had this contradiction best described to me as follows: Copenhagen was China’s chance to air historic grievances with the West. And achieving a major climate target set on Chinese terms is no less a matter of national pride.”

Do you have a sense how CNOOC’s $15.1 billion takeover of Nexen, the Alberta oil sands producer, fits into this discussion? What does China hope to gain from Canada? And should we be worried?

“This is ultimately a technology question. China has potentially huge reserves of unconventional oil and gas, but lacks the technical expertise to exploit them economically. CNOOC is essentially paying $15.1 billion for a crash course in heavy oil extraction. It’s hard to see how the takeover poses major threats to Canadian security. But we should all be concerned about the heavy climate impacts of unconventional fossil fuel production in China.”

Say I’m a cleantech genius with a great product to sell in China. What advice would you give me based on what you found out?

“There’s no single ‘China market.’ The country is an incredibly complex mix of regions, provinces and municipalities, with layers of conflicting rules and ambitions. So don’t go there looking for a quick sell. You’ve got to take the time to really build trust with a Chinese partner. And if you don’t have the resources to protect your key technical know-how from being stolen, you’re probably not ready.”

We hear a lot about how the economic fates of B.C. and China are increasingly intertwined. What did you find in your investigations that told you that was true or else overhyped?

“China clearly represents a huge market for B.C.’s cleantech entrepreneurs, and an equally important buyer of our liquefied natural gas. But we need China in those two instances much more than they need us. That actually gives us much more flexibility than it might seem. Instead of trashing our climate targets in a mad rush to produce and sell off our natural gas, we could be more strategic: develop our fossil resources slowly, and invest some of the revenues into supporting domestic cleantech. That’s a safer long-term bet on our future.”

Beijing’s Second Airport Approved at a Cost of $11.2 Billion

Chinese leaders have given final approval for a long-awaited new $11.2 billion international airport in Beijing to ease crushing congestion at the existing facility, official media said on Monday.

A plane prepares to land at the Beijing Capital International Airport on September 4, 2012. Chinese leaders have given final approval for a new $11.2 billion international airport in Beijing to ease congestion at the existing facility, official media said on Monday.

A plane prepares to land at the Beijing Capital International Airport on September 4, 2012. Chinese leaders have given final approval for a new $11.2 billion international airport in Beijing to ease congestion at the existing facility, official media said on Monday.

The huge new airport south of the capital will have six runways for civilian aircraft and a seventh for military use, the China Daily said, citing CAAC News, a paper linked to the country’s civil aviation administration.

Beijing Capital International Airport, north of the city, has been ranked as the world’s second busiest airport for three years, handling 81.8 million passenger movements in 2012, the China Daily noted.

“The plan for a new airport has been approved by the State Council (China’s cabinet),” it quoted a Beijing aviation spokesman as saying. No official confirmation was immediately available.

Reports said the new airport was scheduled to open by the end of 2018 and have a capacity of 70 million passengers a year by 2025.

It will cost at least 70 billion yuan ($11.2 billion), CAAC News reported, adding that the proposal was made as long ago as 2008 but not approved by the Central Military Commission until the end of last year.

The military enjoys priority over China’s airspace, which has worsened congestion for civilian flights forced to ply narrow air corridors.

Beijing Capital — the world’s second busiest airport after Hartsfield-Jackson in Atlanta — saw a major expansion in the run-up to the 2008 Olympics, reflecting China’s relentless economic rise, but passengers have long complained of delays.

A new airport would put Beijing alongside the likes of New York, London, Paris and Tokyo as cities with more than one major facility.

– Bangkok Post