Bank of England Wants RMB Swap With China

This is a significant development which bolsters the RMB’s internationalization.

———————

The Bank of England is prepared in principle to become the first G7 central bank to enter into a foreign exchange swap agreement with China, opening the door to another substantial step in moves to liberalise the yuan currency.

The bank’s Executive Director for Banking Services, Chris Salmon, told a meeting of senior bankers in London that the move was aimed at underpinning a developing offshore market in yuan trade out of London that Britain is keen to encourage.

It would be the latest in a string of bilateral currency agreements that China has signed in the past three years to promote use of the yuan in trade and investment.

British officials have previously shied away from such a deal because the renminbi (yuan) is not freely exchangeable. But there have been signs that China is moving to open up trading of its currency and Salmon said the bank was more interested in helping yuan business to flourish.

“The Bank would welcome the development of the offshore RMB market just as it would any other legitimate market innovation, and we would not want to inhibit that outcome inadvertently through gaps in our operational framework,” he told the London Money Market Association’s Executive Committee in the text of his speech provided by the bank.

“To remove any residual uncertainty about our attitude: the Bank is ready in principle to agree a swap line with the PBOC (People’s Bank of China), assuming a mutually agreeable format can be identified.”

European and U.S. officials have been pressing China for years to do more to open up the yuan to market forces, saying its artificial weakness was one of the key imbalances of the global economy.

Beijing is slowly delivering, although it still keeps a tight rein on gains for the currency for fear it will weaken an economy that has been the biggest engine of global growth for a decade.

“This is part of the internationalisation of the RMB, this is China moving forward to internationalise its currency,” said David Bloom, head of FX strategy at HSBC.

“They are setting up these lines around the world, it is the beginning of the opening up of the flower of the RMB.”

– Reuters

US Foundation to Send 100,000 Students to China

US Secretary of State Hillary Rodham Clinton, as part of her ongoing commitment to the US-China relationship, on Thursday announced the creation of the 100,000 Strong Foundation to enhance and expand opportunities for US students to learn Mandarin and study in China.

The 100,000 Strong Foundation is a new non-profit effort, housed in American University’s School of International Service in Washington, DC. Its mission is to strengthen the US-China strategic relationship through study abroad.

The Foundation was borne out of a US State Department Initiative of a similar name – the 100,000 Strong Initiative – that was first announced by President Barack Obama in 2009. Secretary Clinton launched the initiative in 2010. The effort has been backed by the Chinese government, which is offering 20,000 scholarships for Americans to study in China. The 100,000 Strong Foundation understands that the future of the US-China strategic relationship rests with our young people.

– newswise.com

Two Chinas

CEO Survey: China to Remain Top Manufacturer for Next Five Years

China, regarded as the top manufacturing destination globally, will retain this spot over the next five years, says an international study which found Germany and the US following it but set to be replaced by India and Brazil.

The situation prevails in China despite factors like rising labour costs and an ageing population, China Daily reported.

Based on interviews with over 550 chief executive officers and senior leaders at manufacturing companies around the world, the survey, co-launched by Deloitte Touche Tohmatsu Ltd. and the United States Council on Competitiveness, was released Tuesday.

Germany and the US came after China in terms of manufacturing competitiveness. But they will be replaced by India and Brazil over the next five years, the survey found.

Ricky Tung, co-leader of the manufacturing industry group of Deloitte China, said the CEO ratings seem to suggest China is becoming more of a developed economy competitor than its emerging economy counterparts.

– IANS

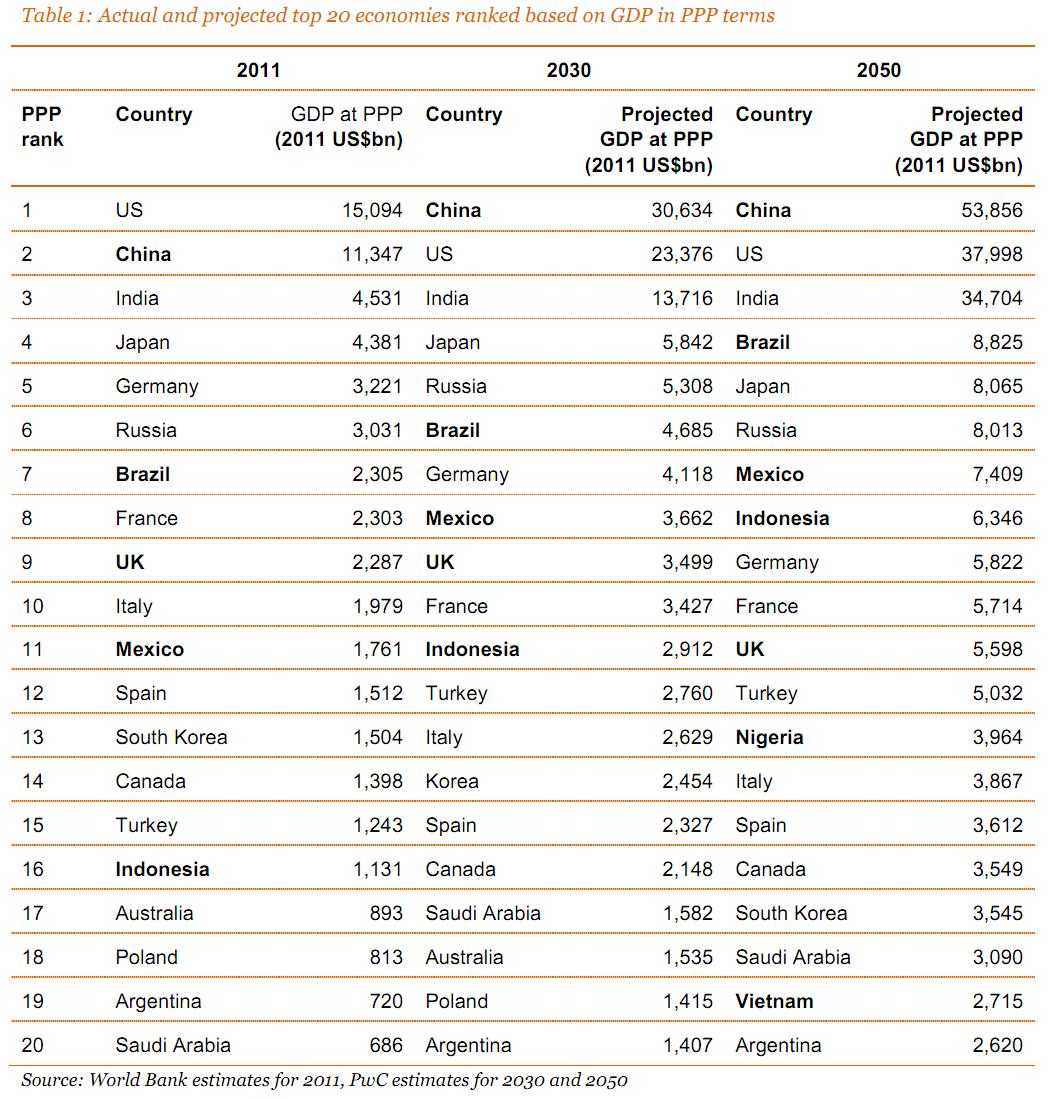

PWC: The World in 2050

PWC came out with its projections for major countries in 2050 below. These studies are innocuous but their scientific value suspect. Nothing to quibble about China and Canada’s positions (fairly conventional) but PWC is too optimistic about India. Especially the average growth rate of around 5.6% over 40 years which sounds unsustainably high. (PWC projects China’s to average around 4.2% over that period which sounds about right or could be a little higher.) A few years ago, India bulls were saying India would surpass China’s growth rate within a few years but look at where India’s growth is now. Numerous factors go into economic growth so these multi-decade studies are educated guesses at best. But fun though.

——————–

The original PwC ‘World in 2050’ study in 2006 covered the 17 largest economies: the G7 (France, Germany, Italy, Japan, the UK, the US and Canada) plus Spain, Australia and South Korea; and the E7 (Brazil, Russia, India, China, Indonesia, Mexico and Turkey).

The extended 2013 study – titled World in 2050 The BRICs and Beyond: Prospects, challenges and opportunities – also includes Vietnam, Nigeria, South Africa, Malaysia, Poland, Saudi Arabia and Argentina.

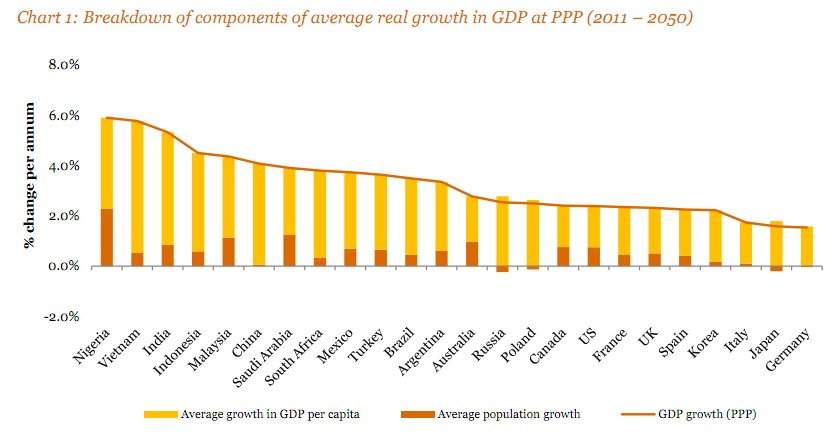

The report concludes that the emerging economies are set to grow much faster than the G7 over the next four decades. Figures for average growth in GDP in purchasing power parity (PPP) terms (which adjusts for price level differences across countries) show Nigeria leading the way over the period from 2012 to 2050, followed by Vietnam, India, Indonesia, Malaysia, China, Saudi Arabia and South Africa.

This means that, in PPP terms:

- The E7 could overtake the G7 before 2020

- By 2050 China, the US and India could be by far the largest economies – with a big gap to Brazil in fourth place, ahead of Japan

- And by the same time, Russia, Mexico and Indonesia could be bigger than Germany or the UK; Turkey could overtake Italy; and Nigeria could rise up the league table, as could Vietnam and South Africa in the longer term.

Here are a couple charts comparing China and India’s growth from the late 1990s to 2011/2012

|

Country |

1999 |

2000 |

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

|

India |

5.5 |

6 |

4.3 |

8.3 |

6.2 |

8.4 |

9.2 |

9 |

7.4 |

7.4 |

10.4 |

7.2 |

12 year average= 7.44% (missing 2001)

From 1979 until 2010, China’s average annual was 9.91%, reaching an historical high of 15.2% in 1984 and a record low of 3.8% in 1990. Based on the current price, the country’s average annual GDP growth in these 32 years was 15.8%, reaching an historical high of 36.41% in 1994 and a record low of 6.25% in 1999.