CBoC: “Walk the Silk Road”

Walking the Silk Road, the title of the Conference Board of Canada’s (CBoC) latest report is indeed evocative. While the US remains Canada’s largest trading partner and will continue to be, emerging (or I should say re-emerging) markets, especially China, are taking an increasing share of both Canadian exports and imports. Canadian businesses must therefore march vigorously down the road to China and other Asian countries in the decades to come, urges the CBoC.

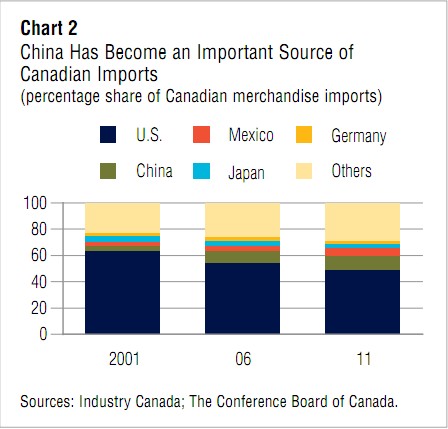

Within a decade, Canadian merchandize heading south of the border has dropped a full 13% from the peak of 87% in 2000-2001 just as China and the UK have seen big increases. Likewise, in the same period, Canadian imports from the US slid from 64% in 2001 to below 50% for the first time as China’s exports to Canada more than tripled to become the second-largest source of imports, accounting for 11% of Canada’s total. And these trends are likely to continue.

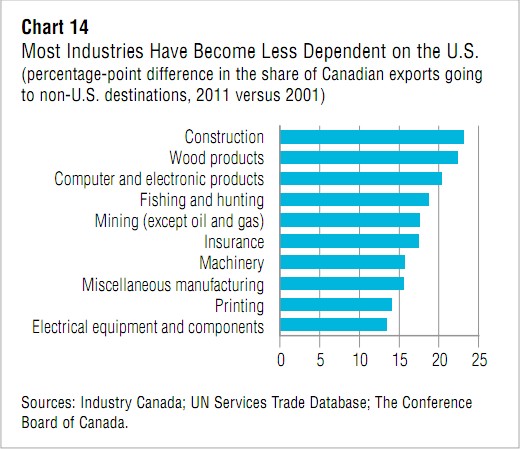

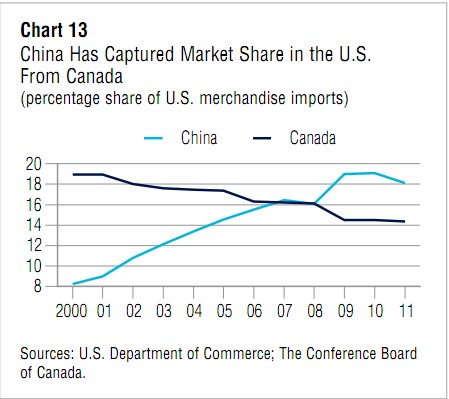

With the exception of communications, mining and miscellaneous manufacturing, Canada’s share of US imports has declined considerably across a range of industries including construction, wood and paper products, forestry and logging, furniture, printing, plastics and rubber, fabricated metal, and others. China, in particular, has steadily taken away that share to surpass Canada as the largest source of the US’s merchandize imports by 2007. Yet, this troubling trend has turned out to be blessing in disguise in driving Canadian businesses to probe new markets around the world.

Canada’s key exports to China include mineral, lumber and pulp, and canola but increasingly new product areas – chemicals, machinery, and aerospace. The same can be said of computers and electronics and services such as insurance in which well known Canadian brands Manulife and Sun Life are expanding aggressively in China and other parts of Asia. So much so that although Canada maintains a large trade deficit with China, that deficit has not deteriorated much since 2008 despite the rising tide of imports from China.

Canada’s key exports to China include mineral, lumber and pulp, and canola but increasingly new product areas – chemicals, machinery, and aerospace. The same can be said of computers and electronics and services such as insurance in which well known Canadian brands Manulife and Sun Life are expanding aggressively in China and other parts of Asia. So much so that although Canada maintains a large trade deficit with China, that deficit has not deteriorated much since 2008 despite the rising tide of imports from China.

CBoC draws some conclusions that are no-brainers: While the US continues to be Canada’s largest trading partner, Canadian companies are increasingly focusing on high growth markets in BRIC countries China, Brazil, and India. Therefore, trade negotiations with these countries will become much broader and of higher priority in the years ahead. Canada is also shifting away from traditional strengths in manufacturing to professional services and natural resources, both sectors in which China plays a major role.

At the same time, “trade between Canada, the US, and China is evolving toward a new and dynamic equilibrium based on trade specialization. Therefore policy should be focused on adaptation and promotion strategies rather than on protection”, underscored the authors.

Dovetailing with the CBoC’s conclusions is Emerging Stronger 2013, a generally upbeat survey by the Ontario Chamber of Commerce (OCC). It found that although 51% of Ontario businesses identified the Great Lakes states as the most critical markets over the next 5-10 years, interestingly, nearly as many, 45%, chose China. They recognize the importance of diversifying exports to China but currently only a fraction of Ontario’s exports go here. Close to 80% of Ontario’s exports are bound for the US while only 1.4% go to China and a paltry 0.3% to India. By contrast, Michigan exports 5.3% of its products and services to China.

Of the nearly 2400 businesses and organizations polled by OCC last December, those in eastern Ontario were most worried about the direction of the province’s economy. Jobs and Prosperity Council (JPC) figures show that Ontario businesses are ill-prepared in trade with only 7% of SMEs involved at all. More depressingly, the average value of Ontario SME exports ranks below that of 47 out of 50 US states!

To help turn things around, OCC wants to leverage Ontario’s large diaspora of Chinese and India immigrants to ferret out trade opportunities. In addition, the JPC wants to hold Global Export Forums, the first of which will highlight China and India and other countries of Asia Pacific. But, to my mind, despite such good intentions at the provincial level which are already late in the game, the federal government should be actively pursuing a free trade pact with China on the heels of the one-year old bilateral Foreign Investment Promotion and Protection Agreement (FIPPA).

US’s Campbell on the US ‘Pivot’ and Not Containing China

While I can agree it isn’t ‘containment’ in the Cold War sense, US-China competition, particularly in Asia-Pacific, is the biggest story in international relations for decades to come. It’s not about China displacing the US as the pre-eminent hegemon. It’s all about China finding its rightful place in the world characterized by several major powers.

————————

|

|

“China is predominant in every aspect of political, financial, economic and security relations. India is still a nascent player in Asia.” Kurt Campbell, the Assistant Secretary of State for East Asian and Pacific Affairs, said at the Aspen Institute, a think-tank, on January 29.

By judgments, he said, the lion’s share of the history of the 21st century’s going to be written in Asia, and the United States has to play a role in that history. “To do so, we must be much more actively engaged, not just for one or two administrations, but for several over a period of years, in every element of our strategy and diplomacy, particularly diplomacy, economic and trade engagement, people to people, cultural exchange,” he said.

“Although the military dimension, which is actually quite modest in this regard, has gotten the most attention, this in many respects, I think what has been under-reported generally is that this has been a diplomatic initiative, by and large,” Campbell said.

“There’s lots of questions about should this be called the rebalance or the pivot or the tilt or, something else. I like ‘rebalancing’, and what I like about the term rebalancing is that it suggests a process that’s going to be in continual evolution, which I believe any aspect of Asian policy necessitates. It requires constant fine tuning. It requires listening carefully to what the region tells us and adjusting our approach accordingly,” he said.

Campbell said the U.S. policy towards the Asia Pacific region is not to contain China.

“I have never heard a senior Chinese diplomat in a formal setting describe American policy as containment,” he said, adding both sides recognise that this is a difficult endeavor, that we have to make our way through very complex challenges.

“Each side has to deal with domestic politics, we have to deal with regional concerns, and we have to recognize that it is natural for two strong players to have areas of tension in the relationship.

– Indolink

Shenzhen in 1980

Interesting gallery of 1980 photos of Shenzhen, two years after the beginning of the reform era. Amazing how the sleepy border town of a few thousand has transformed into a 12 million strong metropolis. Recall Lo Wu Bridge wasn’t even that fancy when I crossed it in 1974 en route to Beijing for school.

Geely Takes Over Iconic London Black Cab Maker

China’s privately owned automaker Zhejiang Geely Holding Group Co said on Friday that it has finalized the acquisition for 11.04 million pounds (US$17.46 million) of Manganese Bronze Holdings, the maker of the iconic London black cabs.

The acquisition includes a plant, equipment and property, intellectual property rights and trademarks, said Geely.

The deal also includes Manganese Bronze’s 48 percent stake in a Shanghai joint venture set up with Geely in 2009 and Manganese Bronze’s stock of unsold vehicles.

Geely, which attracted worldwide attention after its acquisition of Swedish car brand Volvo in 2010, was already a shareholder in Manganese Bronze after buying a 19.97 percent stake in separate deals in 2006 and 2010.

Geely’s priority will be to re-establish the production, sales and servicing of vehicles on broadly the same basis as before Manganese Bronze went into administration last October. This will include the continued assembly of the TX4 model at Coventry plant in the UK, the Chinese company said in a statement.

– China Daily/ANN

Geely said that it is looking at the future needs of the London taxi market, with a view to developing new models to follow the TX4, improving energy efficiency and the environmental footprint of the traditional London cabs, as well as examining the potential for entering the private hire market.

“We are delighted to restore the fortunes of this totemic marque which is known, recognized and admired all around the world. Despite its recent difficulties, we have long believed that the company and the black cab have huge potential,” said Li Shufu, Geely’s chairman.

“We also believe that the brand, technology and design know-how of Manganese Bronze will benefit Geely and our own model range,” Li said.

Zhong Shi, an auto analyst based in Beijing, said that the unprofitable Manganese Bronze was “worth buying”, and that the relatively small deal “won’t bring a huge risk to Geely in the future”.

Gwadar Port is China’s Economic Gateway to Middle East

China threat mongers, especially in US and India, will be all over this. But, its main purpose is economic not military.

————————–

China is poised to take over operational control of a strategic deep-water Pakistani seaport that could serve as a vital economic hub for Beijing and perhaps a key military outpost.

UNFINISHED JOB: The construction of the port, in the former fishing village of Gwadar in troubled Baluchistan province, was largely funded by China at a cost of around $200 million. It has been a commercial failure since it opened in 2007, because Pakistan never completed the road network to link the port to the rest of the country.

OVER THE BOW: Chinese control of the port would give it a foothold in one of the world’s most strategic areas and could unsettle officials in Washington, who have been concerned about Beijing’s expanding regional influence. The port on the Arabian Sea occupies a key location between South Asia, Central Asia and the Middle East. It lies near the Strait of Hormuz, gateway for about 20 percent of the world’s oil.

– AP