Climate Spectator: China’s Unsung Energy Intensity Reduction Efforts

I’ve posted on China’s ongoing and very successful campaign to reduce its energy intensity but here is a good synopsis.

_________________

When I say that I’ve been working in China since 2009 and the organisations I work with have been there since 1999, many people seem to have an irrepressible urge to tell me what they think is happening in the Middle Kingdom. Because most of these informants have never actually been to China, much of what they tell me is plain wrong.

One area about which there is much misinformation is China’s performance on energy efficiency and consequently emissions mitigation. I’m often told that China is doing little about reducing its use of energy and consequently emissions are rising uncontrollably. As with most things about China, the actual situation is more complex.

True, China uses a huge amount of energy and both energy use and emissions are increasing rapidly. As the chart below shows, in 2009 energy use in China surpassed that of the United States.

Energy Use in China and the United States 2000 to 2009 (Mtoe)

Source: International Energy Agency

However, China has a lot more people than the US ‒ 1.35 billion compared with 315 million ‒ and China’s per capita energy use is well below the world average, though it has been increasing sharply since 2001, as shown in the following chart.

Primary Energy Use Per Capita 1960 to 2007 (kgoe/capita)

Source: World Bank World Development Indicators

The most interesting story concerns what’s been happening with China’s energy intensity (energy use per unit of GDP). As shown in the following chart, energy intensity has been decreasing steadily since 1980, except for a short-term blip between 2002 and 2004. Though not shown on the chart, the decrease actually started in 1976.

Energy Intensity in China 1980 to 2009 (Btu/GDP in 2005 $US)

Source: US Energy Information Administration

The following chart shows that energy intensity in China is still higher than in the US but China is trending downwards, whereas the US is pretty static.

Energy Intensity in China and the United States 2005 to 2010 (Btu/$GDP)

Source: Climate Policy Institute/Tsinghua University

The major cause of the long-term and quite steep decline in energy intensity is the extensive, government-driven energy efficiency programs that have been implemented in China, about which little is known in the west.

In part two and three of this series I will expand on the nature of the energy efficiency policies and programs that have been implemented.

David Crossley is a senior advisor with the Regulatory Assistance Project. The Regulatory Assistance Project is a global, non-profit team of experts focused on the long-term economic and environmental sustainability of the power and natural gas sectors, providing assistance to government officials on a broad range of energy and environmental issues.

– Business Spectator

CCC Chief: Canada Playing “Catch-up” in China

During the first Harper government, much petty ideological rhetoric was hurled at China, squandering many Canadian advantages and the efforts of the previous Liberal government. Harper et al. has since made a dramatic turn around but Canadians are still fickle, putting a drag on deepening relations. Here is some frank talk from the president of the Canadian Chamber of Commerce.

————————————-

Prime Minister Stephen Harper is now trying to make up for lost time when it comes to Canada’s ties with China, and there is a lot of work to do to brand Canada as a serious player in the international market, according to the head of the country’s biggest business association.

Perrin Beatty, president and chief executive officer of the Canadian Chamber of Commerce said in an interview last week in Hong Kong that both the federal government and the business community have ignored China’s booming economic growth for too long.

“During the first part of the current government’s term in office I’m not sure they fully understood how much Canada’s strategic interests were international — that our success in Lethbridge would depend on how we’re doing in Hong Kong,” said Beatty. “They’ve learned.”

Beatty said the Harper government is now more focused on diversifying trade beyond the United States and that there has been a “real maturation” in the government’s view on Canada’s relationship with China, but that “we’re playing catch up.”

“The rest of the world is here [in China], they’re branding themselves and doing so effectively,” said Beatty, a former Progressive Conservative member of Parliament and cabinet minister. He was in Hong Kong to meet with local and Canadian people from government and other sectors.

He said Canada used to have a privileged position in China but it was lost partly because successive federal governments did not give it the attention it deserved, and partly because the business community was too focused on the “seductive” American market right next door.

Canadian businesses have to grow internationally and better branding will be key to that success, said Beatty. He said he consistently hears from international contacts that Canada is known for its stunning landscapes and friendly people — not business. That has to change, said Beatty.

“We need to brand Canada as a high-technology, well-educated, dynamic country with a lot to offer in the global marketplace. We haven’t done that,” he said.

Confusion surrounds Canada’s multiple levels of government, each with different responsibilities and ways of doing things, said Beatty, and that can ward off potential foreign trade and business deals. The federal government should take more leadership in presenting Canada as a cohesive country, he said.

Canada’s diplomats and trade commissioners do what they can with the resources they have, said Beatty, and they should get more support to help push Canada ahead.

Canada has 11 offices in China, including the embassy in Beijing, that offer support to Canadian businesses trying to break into the complicated Chinese market. Business associations, such as the Canadian Chamber of Commerce in Hong Kong, are also promoting greater business ties.

Harper has started taking visible steps to strengthen Canada’s relationship with China. He took his second trip there in February 2012 and signed a number of agreements. In September, the controversial Canada-China Foreign Investment Promotion and Protection Agreement was signed.

Canada is much more engaged in China now but is still under pressure and has to “step it up,” said Beatty. He acknowledges that’s easier said than done, however, given China’s complexity and the competition Canada faces. Beatty also acknowledges that reports in the media about intellectual property theft and computer hacking don’t help to strengthen the relationship and that the human rights concerns in some Chinese factories are “very real.”

But foreign companies can help raise working standards and have a positive effect on how China does business, he said, adding that cutting off China because of how it conducts itself would be a “terrible mistake.”

“You don’t isolate China, you isolate yourself. This is an economy that is going to be the number one economy in the world, it is the largest country in the world today by population and its influence in every sphere is increasing dramatically,” he said. “You want to be engaged with somebody like that, you don’t want to assume that they’re going to be begging to do business with you if you don’t make the effort yourself.”

– CBC

Canadian Ambassador: China to Invest More in Canadian Mining and Forestry

Canada’s ambassador to China says money from the Asian country is likely to keep pouring into Canadian resource projects.

But Guy Saint-Jacques also says he thinks those dollars will increasingly flow into mining and forestry as well as energy development.

“I expect that the interest will increase on the mining side,” he said in an interview with The Canadian Press after speaking to an audience at the University of Alberta on Monday.

“What I expect also is maybe they will start to get interested in the forestry sector. There’s already investment in pulp manufacturing. I think they are starting to look at potential minority participation in a number of companies.”

Chinese state-owned companies have already staked out a significant foothold in Alberta’s oilpatch — especially in the oilsands after the federal government approved a $15-billion takeover of Calgary-based Nexen by China National Offshore Oil Corp. late last year. PetroChina has also expressed interest in owning a share of the proposed Northern Gateway, which would ship oilsands bitumen to waiting tankers on Canada’s West Coast.

The amount of Chinese money flowing into energy development is still three times the size of the amount going into mining. But Saint-Jacques, a fluent Mandarin speaker who was appointed ambassador last fall, said that country is looking at other resource opportunities as well.

A Chinese-controlled company now has a plan in front of northern regulators to build major open-pit lead, zinc and copper mines along Canada’s Arctic coast.

There is Chinese interest in northern Ontario’s Ring of Fire mining region and in Saskatchewan’s potash reserves as well, said Saint-Jacques.

In his speech, Saint-Jacques pointed out that Canadian mining exports to China already eclipse Canada’s entire exports to Germany.

Forestry exports are also increasing rapidly.

“Our wood exports to China have grown in spectacular fashion; in fact, 22 times between 2002 and 2012.”

The Chinese, who haven’t traditionally built homes from wood, are beginning to realize its advantages in terms of construction ease and insulation, Saint-Jacques said.

“There are new applications in terms of wood that are being specifically applied to the Chinese market, (such as) replacing the roof of a four- or five-storey building. If they use trusses they can replace a block in just a week, so it’s more efficient and they can also have better insulation.”

Chinese policy-makers are also getting a better sense of how Canada balances different interests in resource development, Saint-Jacques suggested.

“They have become a lot more sophisticated. In a number of cases they have started to have discussions directly with First Nations. I think they have come to understand what we mean by being good corporate citizens. They have refined their thinking.

– Canadian Press

CWF: Build and Expand Pipelines for Alberta Oil Sands Crude

Pipeline bottlenecks are costing Canada multi-millions a day and the reluctance of Canadians to address shortfalls in efficient oil transport to foreign markets could put western Canada’s oil and gas sector at risk, declares Pipe or Perish, a new report by the Canada West Foundation. Commissioned by the government of Saskatchewan, the report also outlined the economic benefits of proposed pipelines to the west coast, eastern Canada, and the eastern seaboard of the US via the mid-west. This post focuses on the implications of burgeoning Asian markets, especially China’s, for Canadian crude exports.

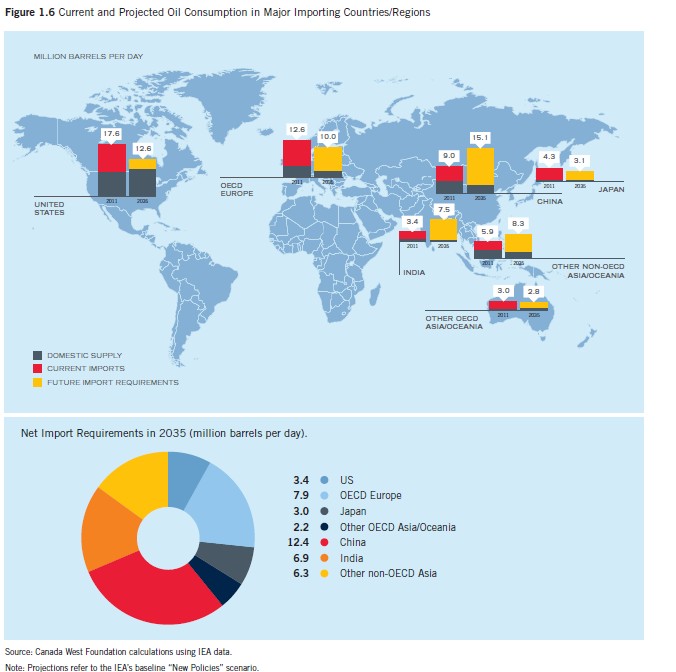

According to International Energy Agency (IEA) world oil consumption scenarios, China is expected to become the world’s largest oil consumer before 2030 and account for half of global growth in oil consumption through 2035. Even in the most stringent ‘450 scenario’ under which China meets emissions targets by 2035 and introduces an escalating system of carbon pricing, her oil demand will not peak for another 13 years (2025). China’s import demand will rise by 153% and other developing Asian markets by 132%.

Eventually, China will need to import more than three times as much oil as western Canada currently produces but Canada has “very little physical access to that market”, the report pointed out. Moreover, going by all long-term supply projections, western Canadian crude production will at least double by 2035. Currently, western Canada has seven major pipelines that transport diluted bitumen, crude oil, and refined petroleum from the region, mainly to the US mid-west.

But, future growth lies in developing Asia, not the US: First, US demand for crude oil and petroleum products is either flat or declining. Add to this booming US production in light of its shale oil and gas revolution that will dramatically reduce American dependency on foreign oil. Further, there is substantial resistance to the oil sands from US environmentalists who have lobbied the Obama Administration hard against the Keystone XL pipeline. Finally, due to pipeline bottlenecks, western Canadian producers are selling oil at steeply discounted prices.

Given the refinery building boom in China, it is more rational for Canadian producers to sell crude rather than refined products, argued the report: “The combination of high capital costs and small per-barrel return on that investment makes bitumen upgrading a risky proposition. Rather than expose ourselves to that risk, many companies are choosing simply to export diluted bitumen to US (foreign) refiners”.

Currently, Kinder Morgan’s Trans Mountain pipeline is the only direct link to the west coast but improving access to Asia via this line is limited because it is only able to deliver 300,000 barrels a day (b/d). Refined products go to BC customers and crude oil to Washington State for refining. Only a tiny fraction lands at the Burnaby Terminal for overseas shipment.

The critical but controversial Enbridge Northern Gateway line from Edmonton to Kitimat would be able to transport 530,000 b/d of diluted bitumen and synthetic crude. Expansion of Kinder Morgan Trans Mountain from Edmonton to Vancouver would add another 590,000 b/d in crude oil and refined products. Together, these two pipelines would be able to transport nearly 1 million b/d of crude to Asian markets. But, the challenge, underscored the report, is “getting these projects approved and completed in a timely manner”.

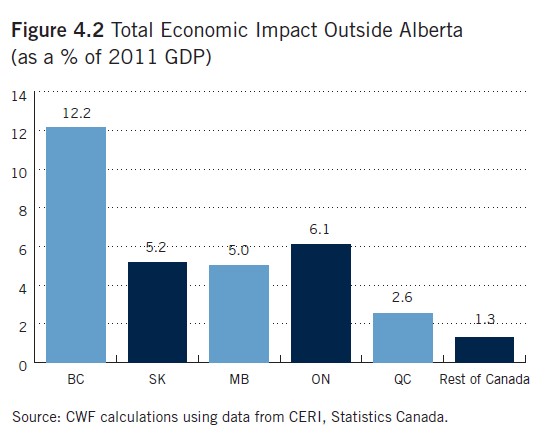

The combined economic impact of extending Trans Mountain and building Keystone XL and Northern Gateway would be immense, Michael Holden, senior economist and author of the report, told the Canadian press: “(if the three pipeline proposals don’t go forward) Canada will be foregoing $1.3 trillion in economic output and 7.4 million person-years of employment and $281 billion in tax revenue between now and 2035”. While the lion’s share of benefits will go to Alberta, an additional $84 billion in economic activity would accrue to other provinces, including $32 billion to other western provinces.  By far, the biggest beneficiary outside of Alberta will be BC which would gain the equivalent of 12.2% in 2011 provincial GDP over the projection period. Combined with other pipeline proposals going east and south, Ontario, Saskatchewan, and Manitoba would enjoy a boost of between 5% and 6.1% in 2011 GDP terms.

By far, the biggest beneficiary outside of Alberta will be BC which would gain the equivalent of 12.2% in 2011 provincial GDP over the projection period. Combined with other pipeline proposals going east and south, Ontario, Saskatchewan, and Manitoba would enjoy a boost of between 5% and 6.1% in 2011 GDP terms.

Infographic: Expensive Foreign Products in China

This is a frequent complaint from Chinese consumers. Hence, their penchant to shop overseas for famous brands. Not-so-famous-brand imported foods are also unreasonably high (tariffs etc. as explained in the infographic). To be fair, price disparities between foreign and Chinese brands can be massive. For instance, at certain Chinese coffee shops, coffee can be as cheap as 8 RMB per cup, using the same beans and espresso machines.

—————–  – business.sohu.com via East-West-Connect.com

– business.sohu.com via East-West-Connect.com