RMB 1/4 of All China’s Cross Border Payments

This is a major milestone. With the increasing role of the RMB in Chinese cross-border trade and investments, it would not be surprising if the rate of RMB cross-border settlements reaches 1/3 by the end of this year. At this pace, perhaps the vast majority of China’s payments will be made in RMB by the end of the decade.

——–

Nearly a quarter of all cross-border payments in China last year were settled in yuan (CNY=), the central bank said on Tuesday, underscoring the renminbi’s growing dominance as it heads into the league of major currencies.

A total of 9.95 trillion yuan (1.06 trillion pounds) worth of cross-border payments were made in yuan last year, the People’s Bank of China (PBOC) said in a statement on its website, as it vowed to increase international usage of the currency this year.

The total value for yuan cross-border payments in 2013 was not available.

The yuan’s rising global profile mirrors its surging trading volume worldwide.

Although still tightly controlled by China’s government, offshore trading in the yuan soared some 350 percent on Thomson Reuters trading platforms last year. Rival platform EBS said the yuan ended 2014 as one of its top five traded currencies.

To encourage investors and central banks around the world to use the yuan, China began an experiment known as the Renminbi Qualified Foreign Institutional Investor scheme, or “RQFII”, that allows those who hold the yuan to re-invest it in Chinese capital markets.

And growth in the RQFII has been rapid. The size of the scheme more than trebled to 870 billion yuan at the end of last year, central bank data showed. That is up from 270 billion yuan in March 2014, according to the People’s Daily, the official newspaper of the Communist Party.

Ten nations outside China now buy Chinese assets via the RQFII, 14 countries have yuan clearing arrangements, and 28 other central banks have currency swap lines with China, the PBOC said.

China wants to turn the yuan into a global currency partly to reduce its reliance on the dollar, which is estimated to account for roughly a third of its $3.84 trillion foreign exchange reserves.

The weight of the dollar in Chinese reserves is especially problematic when the greenback weakens as it inflicts financial losses on China, at least on paper.

– Reuters

Bohai Strait Undersea High Speed Rail May be Built: Chinese Media

This has been brewing for some time and hopefully it gets into the 13th Five-Year Plan. Currently, it is indeed a pain to get from Dalian to Yantai, unless you fly, but that’s just as much a hassle.

An ambitious high-speed railway to run beneath Bohai Sea may be taken into consideration when the National Development and Reform Commission (NDRC), China’s economic planner, decides its 13th five-year plan (2016- 2020), 21st Century Business Herald reported on Tuesday.

Zhang Wufeng, head of the NDRC in Shandong province, said it has agreed to “consider” and “support” the project that would connect Lushun in Dalian city, Northeast China’s Liaoning province, with Penglai in Yantai, situated in Shandong.

It now takes over 10 hours to travel the over-1000-kilometer land route between Lushun and Penglai, which are separated by Bohai Sea and located on the Liaodong and Shandong peninsulas respectively. The proposed underwater high-speed railway would shorten the distance to over 100 kilometres while the travelling time would be reduced to 40-50 minutes, said Wang Mengshu, academician at the Chinese Academy of Engineering and tunnel expert. Wang added that the rail link will run at 250 kilometers per hour according to its design.

The connection will promote economic development in the region, especially in provinces with advanced steel industries like Liaoning, Hebei and Shandong, and enhance economic interaction among Shandong, Liaoning, Beijing, Tianjin and Hebei, say experts

It is predicted that by 2020, the potential passenger flow volume between the two areas will reach about 300 million, with the figure for the underwater high-speed rail to hit 180 million to 240 million. It is calculated that the first phase of the project might cost 200 billion to 250 billion yuan ($32.1 billion – 40.2 billion).

– english.eastday.com

Will Abe Piss Off Japan’s Closest Neighbours Again?: Bloomberg

Japanese Prime Minister Shinzo Abe has a knack for pissing off especially China and South Korea (never mind the whacko North) whether it be trying to minimize the numbers massacred during the Rape of Nanking (or his goons denying it ever happened), or insisting the euphemistic “Comfort Women” became sex slaves of their own volition, or denying atrocities committed against Allied prisoners of war, or arguing the Diaoyus have always belonged to the Japanese, or grand standing about reassessing the Murayama apology, or sending offerings to or visiting the Yasukuni Shrine, and the list goes on.

Indeed, everyone is waiting to hear what he intends to say at the 70th anniversary of the end of WWII.

My guess is he’ll utter all the politically correct language, grudgingly acknowledge and uphold former Prime Minister Tomiichi Murayama’s 1995 apology, and swear on Japan’s unswerving commitment to peace and democracy. He’ll go back home, lay low for a while, send expressions of respect to Yasukuni Jinja where the ashes of 14 war criminals lay, and in a couple years, amend the constitution to rid once and for all of Article 9, and when he needs to or the time is right (either due to pressure from the ultra-right or he wants to show the Chinese and Koreans that he can stand up to them) pay another visit with his cabinet colleagues to the shrine.

The Japanese right wing will NEVER truly atone for what the militarists did in WWII because they perceive themselves as victims who paid the ultimate price of enduring the atomic bomb. After all, Abe’s grandpop was intimately involved in the war-time policies. On a personal level, Abe is not going to offer any additional expression of apology that is tantamount to rejecting what his relatives did during the war.

This Bloomberg article is right that Abe has to set the right tone internationally. Otherwise, his diplomatic offense will backfire.

http://finance.yahoo.com/news/japan-wants-peace-builder-keeps-012030640.html;_ylt=AwrTWVWzVL5UUXQAhBrQtDMD

40% of Britons Want to Walk the Great Wall: Survey

Did not realize Britons were so infatuated with the Great Wall.

Here’re their top ten dream destinations:

1.Walking along the Great Wall of China – 40%

2. Hiking into the Grand Canyon – 31%

3. Trekking the Inca trail – 25%

4. Walking the Nile – 21%

5. Diving with great white sharks – 17%

6. Hiking the great Himalaya trail, Nepal – 17%

7. Skydiving over the Great Barrier Reef – 16%

8. Climbing the summit of Mount Everest -15%

9. Expedition across the Antarctic – 13%

10. White water rafting down the Coruh River in Turkey -10

A new survey suggests that far from being couch potatoes as we’re often portrayed, the British are really rather an adventurous bunch. At least in theory…

Figures from the CWM FX London Boat Show reveal that 40 per cent of Brits dream of making a pilgrimage to The Great Wall of China, which stretches for an incredible 5,500 miles across north of the country, while just over a third of people claim that visiting the Grand Canyon in Arizona tops their list of dream destinations.

China is Not Colonizing Africa and There Are Many Players: Economist

This Economist piece starts out okay by debunking recent Western AND certain African portrayals of China’s decade-long engagement with Africa as somehow “neo-colonialist”, “neo-imperialist” or China’s “second continent” as Howard French, the former New York Times China correspondent, titled his new book. But, it seems to confuse Chinese state policy toward Africa such as the China-Africa forum and the many state visits bringing investment and aid with the hundreds of thousands of small-time Chinese businessmen who have been going to the continent in search of business opportunities since the early 2000s. Many intend to stay over the long haul and have made Africa their new home.

The piece is right about the many international players that are now there (in part because of China’s dual challenge of state policy and investment and small business inroads) and China’s explicit rejection of a colonial agenda. China has no troops on the ground aside from UN peacekeepers and it hasn’t any colonial-style administrations in the many countries it deals with. And it doesn’t treat the local people like children needing their governance.

Unlike hypocritical Western countries, China deals with all African countries that want to strengthen ties so China builds railroads in Nigeria, Tanzania, Zambia and Kenya; searches for oil and builds refineries and pipelines in the two Sudans and Angola, and provides over $122 million dollars in medical and financial aid as well as dispatching hundreds of medical personnel to Ebola-stricken countries in West Africa. In short, neither the Chinese state nor its businessmen harbor any dreams of colonial conquest and overlordship in Africa.

However, the Chinese government and state corporations do want resources in exchange for investment and infrastructure building. They also want to help create vibrant markets in Africa. Enlightened self interest works for both sides. If their presence is no longer welcomed, and that won’t come to pass, they can easily find willing partners on other continents such as in Latin America, the Arab world, Eastern Europe, and even parts of North America, notably Mexico. The Chinese government is smart enough to develop a multi-pronged strategy that assures it does not have all its eggs in any one basket. Even if problems do come to a boil, will the West and other countries such as India pick up the slack? Don’t hold your breath.

And what about the legions of small entrepreneurs that opened businesses and factories, set up shops, tilled fields, or otherwise engaged in trade with the continent? It’s about making a living and should circumstance allow, even get rich. If the going gets too tough businesswise or there is too much political backlash, they’ll simply pack up and head for greener pastures and there are many to go to. Should that comes to pass, and it won’t, it will be a loss for Africa, indeed.

———-

China has become by far Africa’s biggest trading partner, exchanging about $160 billion-worth of goods a year; more than 1m Chinese, most of them labourers and traders, have moved to the continent in the past decade. The mutual adoration between governments continues, with ever more African roads and mines built by Chinese firms. But the talk of Africa becoming Chinese—or “China’s second continent”, as the title of one American book puts it—is overdone.

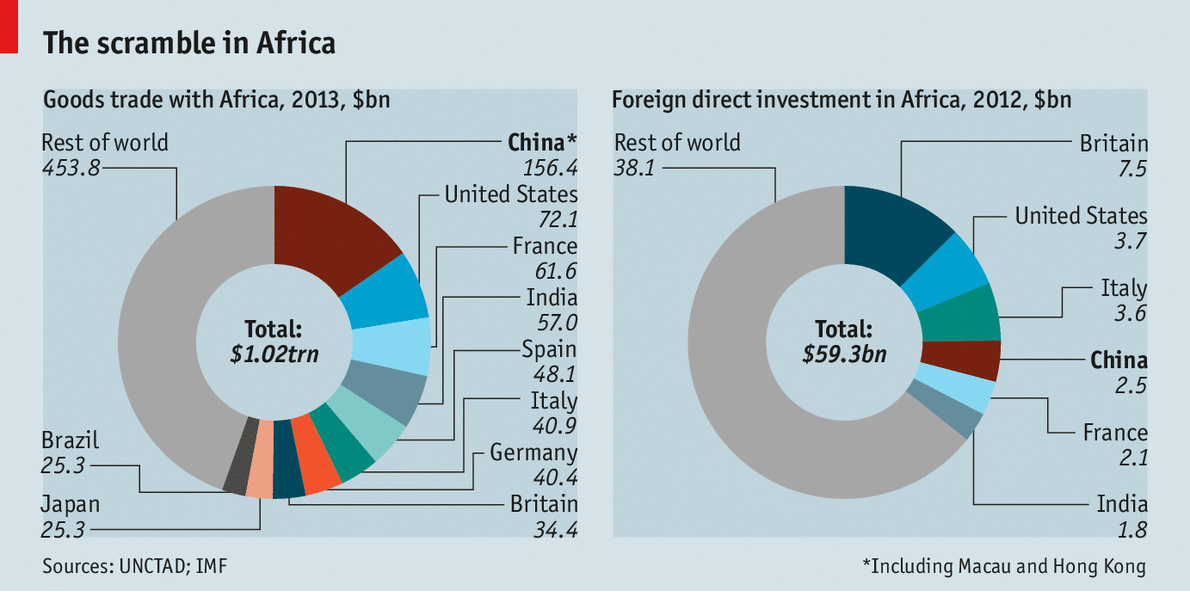

The African boom, which China helped to stoke in recent years, is attracting many other investors. The non-Western ones compete especially fiercely. African trade with India is projected to reach $100 billion this year. It is growing at a faster rate than Chinese trade, and is likely to overtake trade with America. Brazil and Turkey are superseding many European countries. In terms of investment in Africa, though, China lags behind Britain, America and Italy (see charts).

If Chinese businessmen seem unfazed by the contest it is in part because they themselves are looking beyond the continent. “This is a good place for business but there are many others around the world,” says He Lingguo, a sunburnt Chinese construction manager in Kenya who hopes to move to Venezuela.

A decade ago Africa seemed an uncontested space and a training ground for foreign investment as China’s economy took off. But these days China’s ambitions are bigger than winning business, or seeking access to commodities, on the world’s poorest continent. The days when Chinese leaders make long state visits to countries like Tanzania are numbered. Instead, China’s president, Xi Jinping, has promised to invest $250 billion in Latin America over the coming decade.

The growth in Chinese demand for commodities is slowing and prices of many raw materials are falling. That said, China’s hunger for agricultural goods, and perhaps for farm land, may grow as China’s population expands and the middle class becomes richer.

For the article in its entirety see: http://www.economist.com/news/middle-east-and-africa/21639554-china-has-become-big-africa-now-backlash-one-among-many