New Book on the Rise of the Renminbi

Eswar Prasad is a renowned economist at Cornell University mentioned before on this blog and an expert on the trajectory of the renminbi (RMB). His most recent book Gaining Currency: The Rise of the Renminbi provides a vivid account of its growing influence around the world but also the challenges and obstacles that lie ahead for the ‘redback’. Its rapid rise following the global financial crisis is shown in the charts below, albeit still at very low level.

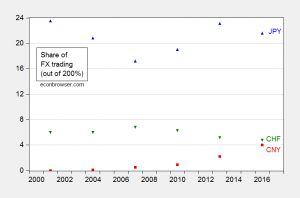

Share of OTC forex turnover accounted for by the RMB (red), the Japanese yen (blue) and the Swiss franc (green).

Mr Prasard is cautiously optimistic about the prospects of the “people’s currency” and he’s probably right that it won’t take over from the dollar anytime soon. However, in the coming decade or two, it will certainly be a strong contender for the no.2 spot, most likely displacing the euro. He also underestimates the Chinese government’s commitment to political, legal and institutional reforms and is wrong that the currency will not attain “safe haven” status for investors. If not Western investors, certainly Asian and developing world investors will want to buy RMB to hedge against crises.

The book’s website writes: Gaining Currency traces the RMB’s ascendancy from revolutionary symbol to reserve currency held by foreign central banks. Prasad reveals the interconnections linking China’s growing economic might, its expanding international influence, and the rise of its currency. If China plays its cards right by adopting reforms that put its economy and financial markets on the right track, the RMB could rival even the euro and the Japanese yen.

Prasad shows, however, that while China has successfully adopted a unique playbook for promoting the RMB, many pitfalls lie ahead for its economy and currency that could limit the RMB’s ascendance. The Chinese leadership is pursuing financial liberalization and limited market-oriented reforms…While the RMB is likely to become a significant reserve currency, it will not attain “safe haven” status as a currency to which investors turn during crises.